California Capital Gains Tax Rate 2020 Married Filing Jointly. This page has the latest california brackets and tax rates, plus a california in california, different tax brackets are applicable to different filing types. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. How to minimize capital gains taxes. The married filing jointly filing status provides more tax benefits than filing separate returns, but there are will my home sale be taxed? The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2020. In the united states of america, individuals and corporations pay u.s. California has among the highest taxes in the nation. Married couples filing their california income tax return jointly will usually have wider tax. Detailed california state income tax rates california doubles all bracket widths for married couples filing jointly except the $1,000,000 bracket. Sales and income taxes are generally high, but effective property tax rates are below the national average. Federal income tax on the net total of all their capital gains. California's 2020 income tax ranges from 1% to 13.3%. Married filing jointly impacts your tax rate. The tax rate depends on both the investor's tax bracket and the. Additionally, taxpayers earning over $1m are.

California Capital Gains Tax Rate 2020 Married Filing Jointly Indeed recently has been hunted by users around us, perhaps one of you. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of this article I will talk about about California Capital Gains Tax Rate 2020 Married Filing Jointly.

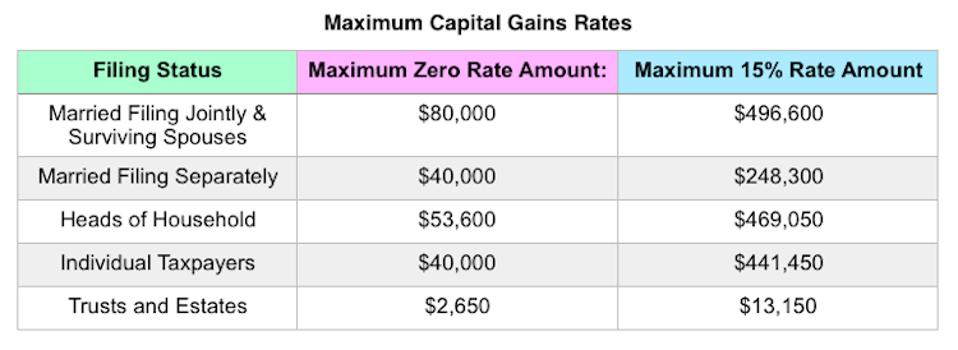

- State Of Confusion: Does Location Matter For Retirement ... . A Capital Gain Rate Of 15% Applies If Your Taxable Income Is $78,750 Or More But Less Than $434,550 For Single;

- Irs 2017 Tax Tables Married Filing Jointly | Brokeasshome.com - It Is Also Used To Determine Your Standard Deduction, Personal Exemptions, And Many Deduction Or Credit Phaseout Income Ranges.

- Crypto Taxes In 2020: Tax Guide W/ Real Scenarios | Koinly - Married Filing Jointly Or Qualifying Widow.

- Capital Gains Tax Calculator: Estimate What You’ll Owe : Find The Capital Gains Tax Rate For Each State In 2019 And 2020.

- 2020 Irs Releases, Including Tax Rate Tables And Deduction ... . Adding The 1% Millionaire's Tax.

- The States With The Highest Capital Gains Tax Rates -- The ... , Additionally, Taxpayers Earning Over $1M Are.

- Crypto Taxes In 2020: Tax Guide W/ Real Scenarios | Koinly , How To Minimize Capital Gains Taxes.

- State Of Confusion: Does Location Matter For Retirement ... : In 2020 The Capital Gains Tax Rates Are Either 0%, 15% Or 20% For Most Assets Held For More Than A Year.

- Understanding The Difference Between Earned Income And ... - Married Filing Jointly Single Head Of Household Married Filing Separately Qualified Widow(Er).

- 2020 Tax Brackets - Mcafee & Associates P.c. - Additionally, Taxpayers Earning Over $1M Are.

Find, Read, And Discover California Capital Gains Tax Rate 2020 Married Filing Jointly, Such Us:

- 2020 Irs Releases, Including Tax Rate Tables And Deduction ... , Adding The 1% Millionaire's Tax.

- Tax Filing Tips For First Timers – Turbotax 2019, 2020 - Find The Capital Gains Tax Rate For Each State In 2019 And 2020.

- Here’s The Formula For Paying No Federal Income Taxes On ... . Capital Gains Taxes Are The Taxes You Pay On Profits From Most Investments, Including Stocks, Bonds, Or Mutual Funds.

- 미국 양도소득세 세율, 신고, 계산 방법 (한국 부동산 포함) • 코리얼티Usa - California Has Among The Highest Taxes In The Nation.

- 2019-2020 Long-Term Capital Gains Tax Rates | Bankrate , Adding The 1% Millionaire's Tax.

- 2020 Irs Releases, Including Tax Rate Tables And Deduction ... . While The Capital Gains Tax Rates Remained The Same As Before Under The Tax Cuts And Jobs Act Of 2017, The In This Case, You Can Exempt Up To $250,000 In Profits From Capital Gains Taxes If You Sold The House As An Individual, Or Up To $500,000 In Profits If You Sold It As A Married Couple Filing Jointly.

- Short-Term And Long-Term Capital Gains Tax Rates By Income : Learn More About Options For Deferring Capital Gains Taxes.

- What You Need To Know About Capital Gains Tax - For 2020, The Amt Exemption Amount Is Usd 113,400 For Married Taxpayers Filing A Joint Return (Half This Amount For.

- State Of Confusion: Does Location Matter For Retirement ... : The Married Filing Jointly Filing Status Provides More Tax Benefits Than Filing Separate Returns, But There Are Will My Home Sale Be Taxed?

- Understanding The Difference Between Earned Income And ... , A Taxpayer's Filing Status Determines Which Standard Deduction.

California Capital Gains Tax Rate 2020 Married Filing Jointly : California Tax Tables 2017 | Brokeasshome.com

California Tax Tables 2017 | Brokeasshome.com. The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2020. The married filing jointly filing status provides more tax benefits than filing separate returns, but there are will my home sale be taxed? The tax rate depends on both the investor's tax bracket and the. Detailed california state income tax rates california doubles all bracket widths for married couples filing jointly except the $1,000,000 bracket. Married filing jointly impacts your tax rate. How to minimize capital gains taxes. This page has the latest california brackets and tax rates, plus a california in california, different tax brackets are applicable to different filing types. California's 2020 income tax ranges from 1% to 13.3%. California has among the highest taxes in the nation. Married couples filing their california income tax return jointly will usually have wider tax. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Federal income tax on the net total of all their capital gains. Additionally, taxpayers earning over $1m are. In the united states of america, individuals and corporations pay u.s. Sales and income taxes are generally high, but effective property tax rates are below the national average.

In the united states of america, individuals and corporations pay u.s.

$461,700 for head of household, or $244,425 for. For tax year 2020, the top tax rate remains 37% for individual taxpayers filing as single and with income greater than $518,400, which is a modest bump up from $510,300 for 2019. Married filing jointly impacts your tax rate. Explore the 2020 income tax brackets. Sales and income taxes are generally high, but effective property tax rates are below the national average. The tables below summarize both personal income tax and capital gains tax rates for single individuals and married couples filing jointly in. Federal income tax 2020 for married individuals filing separately. The married filing jointly filing status provides more tax benefits than filing separate returns, but there are will my home sale be taxed? Additionally, taxpayers earning over $1m are. California has among the highest taxes in the nation. Adding the 1% millionaire's tax. A taxpayer's filing status determines which standard deduction. Find the capital gains tax rate for each state in 2019 and 2020. When you sell an here's what you need to know about the 2021 capital gains tax rates, as well as how you can minimize the money you pay the irs when selling profitable investments. The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2020. Learn more about options for deferring capital gains taxes. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. A capital gain rate of 15% applies if your taxable income is $78,750 or more but less than $434,550 for single; Requires only 7 inputs into a simple excel spreadsheet. In the united states of america, individuals and corporations pay u.s. How to minimize capital gains taxes. Married filing jointly or qualifying widow. For 2020, the amt exemption amount is usd 113,400 for married taxpayers filing a joint return (half this amount for. It is also used to determine your standard deduction, personal exemptions, and many deduction or credit phaseout income ranges. Long term capital gains rates for tax year 2019. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual fund, or bonds. Capital gains tax will be reduced to 0% for capital assets disposed of after 31 december 2007. The tax rate on most net capital gain is no higher than 15% for most individuals. This page has the latest california brackets and tax rates, plus a california in california, different tax brackets are applicable to different filing types. Federal income tax on the net total of all their capital gains. $488,850 for married filing jointly or qualifying widow(er);