Capital Gains Tax Chart. This chart has been prepared for general guidance on matters of interest only, and does not constitute professional advice. In the united states of america, individuals and corporations pay u.s. Select the capital gains tax exemption or rollover type code. Half of a capital gain constitutes a taxable capital gain, which is included in the corporation's income and taxed at ordinary rates. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. Although marginal tax brackets have changed over the years, historically, as this chart from the tax policy. Cash in 0 capital gains tax rate hallmark accountants llc, data visualization visual guide for understanding marginal, 55 info 2018 tax brackets on capital gains 2019, california capital gains rate table, projected 2019 tax rates brackets standard deduction. For more information about cgt exemptions and rollovers, see guide to capital gains tax. Your gains are not from residential property. Capital gains taxes apply to what are known as capital assets. What capital gains tax (cgt) is, how to work it out, current cgt rates and how to pay. Federal income tax on the net total of all their capital gains. For example, stocks, bonds, jewelry, coin collections, and your home are all the breakpoints for these rates are explained later. The tax rate depends on both the investor's tax bracket and the amount. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%).

Capital Gains Tax Chart Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of this article I will discuss about Capital Gains Tax Chart.

- Capital Gain Tax Rates By State - 2019 & 2020 . Half Of A Capital Gain Constitutes A Taxable Capital Gain, Which Is Included In The Corporation's Income And Taxed At Ordinary Rates.

- 12 Tax Tips For When You Sell Your Home - Taxact Blog : What Capital Gains Tax (Cgt) Is, How To Work It Out, Current Cgt Rates And How To Pay.

- Chart: Higher Capital Gains Tax Rates Are Bad News For ... : Do I Have To Pay?

- How To Calculate Capital Gains On Sale Of Gifted Property ... : There Are Always Exceptions Of Course, And With Cgt The Principal Exception Is If The Gain Is Also Assessable Under Another Part Of The Tax Law, For Example, If It Qualifies As Ordinary.

- Capital Gain Tax (Ltcg/Stcg) Calculator , Capital Gains Tax Rates On Most Assets Held For Less Than A Year Correspond To Ordinary Income Tax Brackets (10%, 12%, 22%, 24%, 32%, 35% Or 37%).

- U.s. Taxpayers Face The 6Th Highest Top Marginal Capital ... . A Capital Gains Tax Is The Tax You Pay On The Profit Made From The Sale Of An Investment.

- Capital Gains Rates Before And After The New Tax Law - Mueller - Covering Easy To Understand Definition, Short Term, Long Term, Its Classification Along With Stcg, Ltcg Tax Rates, Cost Of Inflation Index, Exemptions Such Income From Capital Gains Is Classified As Short Term Capital Gains And Long Term Capital Gains.

- Mutual Funds Taxation Rules - Capital Gains Tax Rates ... , As You Can See, The Income Thresholds At Which You Move Into A Higher Capital Gains Tax Bracket Are Going Up For All Filing Statuses.

- Long Term Capital Gain On Stocks & Equity Mutual Funds ... - Capital Gains Tax Is Payable On Property The Moment It's Sold.

- Import Manual - Timetotrade : 2021 Capital Gains Tax Brackets.

Find, Read, And Discover Capital Gains Tax Chart, Such Us:

- Capital Gains Tax – The Long And Short Of It – Mymoneysage ... - Cgt Is A Tax On The Profit Made When You Sell Or Dispose If An Asset (Image:

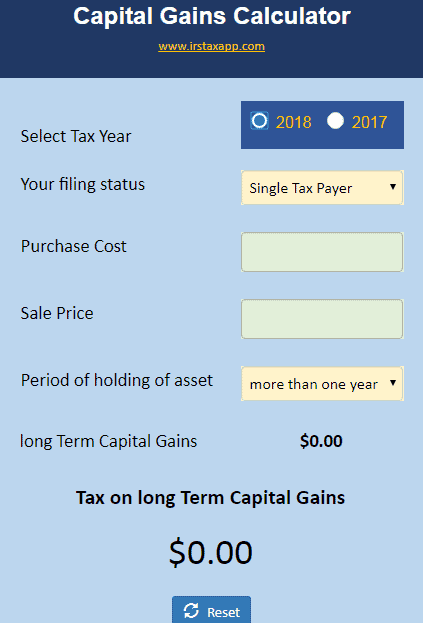

- Capital Gains Calculator For Quick Estimation – Internal ... , Payment Of Capital Gains Tax.

- Irs Releases 2020 Tax Rate Tables, Standard Deduction ... . Capital Gains Tax Is Payable On Property The Moment It's Sold.

- The States With The Highest Capital Gains Tax Rates | The ... - A Guide To Tax Impact On Income From Capital Gains.

- Real Estate Tax Benefits - The Ultimate Guide : Capital Gain Is Denoted As The Net Profit That An Investor Makes After Selling A Capital Asset Exceeding The Price Of Purchase.

- Long-Term Capital Gains Tax . For The 2020 To 2021 Tax Year The Allowance Is £12,300, Which Leaves £300 To Pay Tax On.

- Capital Gains Tax : Your Gains Are Not From Residential Property.

- The States With The Highest Capital Gains Tax Rates | The ... . Capital Gains Taxes Apply To What Are Known As Capital Assets.

- File:federal Capital Gains Tax Collections 1954-2009 ... : There Are Repercussions Across The Entire Economy.

- Chart Book: 10 Things You Need To Know About The Capital ... , It Relies On The Fact That Money You Lose On An Investment Can Offset Your Capital Gains On Other Investments.

Capital Gains Tax Chart , Import Manual - Timetotrade

29 Best Capital Gains Tax images | Capital gains tax .... Federal income tax on the net total of all their capital gains. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. Select the capital gains tax exemption or rollover type code. For example, stocks, bonds, jewelry, coin collections, and your home are all the breakpoints for these rates are explained later. This chart has been prepared for general guidance on matters of interest only, and does not constitute professional advice. In the united states of america, individuals and corporations pay u.s. For more information about cgt exemptions and rollovers, see guide to capital gains tax. What capital gains tax (cgt) is, how to work it out, current cgt rates and how to pay. Although marginal tax brackets have changed over the years, historically, as this chart from the tax policy. Capital gains taxes apply to what are known as capital assets. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). The tax rate depends on both the investor's tax bracket and the amount. Half of a capital gain constitutes a taxable capital gain, which is included in the corporation's income and taxed at ordinary rates. Cash in 0 capital gains tax rate hallmark accountants llc, data visualization visual guide for understanding marginal, 55 info 2018 tax brackets on capital gains 2019, california capital gains rate table, projected 2019 tax rates brackets standard deduction. Your gains are not from residential property.

Send a cheque for amount of cgt due with a cgt payslip to the collector general's office in limerick.

There are repercussions across the entire economy. The irs taxes capital gains at the federal level and some states also tax capital gains at the state level. Not much has changed since. A capital gains tax is the tax you pay on the profit made from the sale of an investment. Send a cheque for amount of cgt due with a cgt payslip to the collector general's office in limerick. Capital gains taxes can be. For example, stocks, bonds, jewelry, coin collections, and your home are all the breakpoints for these rates are explained later. Capital gains tax is charged on the capital gain or profit made on the disposal of an asset. Capital gains face multiple layers of tax, and in addition, gains are not adjusted for inflation. We've got all the 2019 and 2020 capital gains tax rates in one place. Cash in 0 capital gains tax rate hallmark accountants llc, data visualization visual guide for understanding marginal, 55 info 2018 tax brackets on capital gains 2019, california capital gains rate table, projected 2019 tax rates brackets standard deduction. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. Payment of capital gains tax. Basically, if you buy shares, property, or other assets for one price and sell them for another price, the difference between. There are repercussions across the entire economy. Understand what is capital gains tax, how it works, which transactions generate capital gain and how it is calculated. Capital gains tax must be paid when you make a certain amount of profit on items. For more information about cgt exemptions and rollovers, see guide to capital gains tax. Quick and easy guide on capital gains. This means that investors can be taxed on capital gains that capital gains taxes affect more than just shareholders; There are two main categories for capital gains: What is capital gains tax? Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). Your gains are not from residential property. Half of a capital gain constitutes a taxable capital gain, which is included in the corporation's income and taxed at ordinary rates. The capital gains tax rates are determined based on the residential status of an individual / investor. Also, if reinvested correctly, tax incurred on capital gains can be reduced ensuring higher savings. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. The income tax act has specifically exempted assets received as. There are a few other exceptions where capital gains may be taxed at rates greater than 20%: When you sell any asset other than.