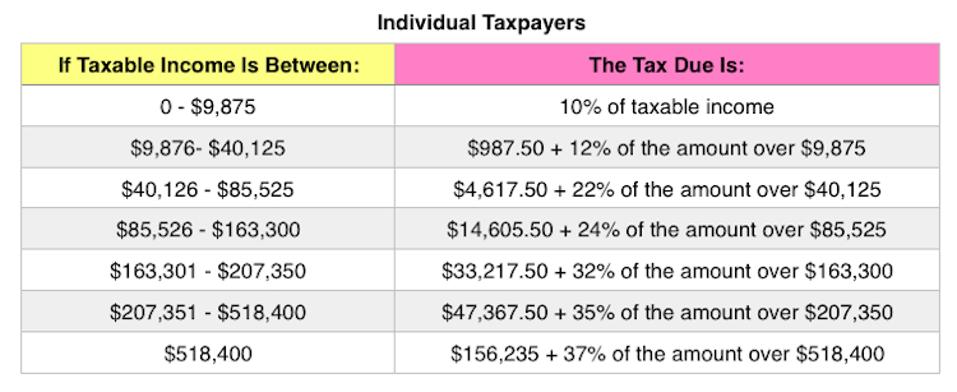

Federal Capital Gains Tax Brackets 2020. See how tax brackets work & how to cut your tax. The federal tax brackets increases are highly dependent on the changes to the cost of living, changes to the tax system, and the inflation rate. Which federal income tax bracket are you in? Our opinions are our own. 2020 tax brackets, tax foundation and irs topic number 559. Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know let's use the tax bracket for 2020 and say your filing status is single and you earned $70,000. The exclusion is increased to $157,000 for gifts to spouses who are not citizens of the. There are seven federal tax brackets for the 2020 tax year: 2020 capital gains tax rates (long term capital gains). In 2020, the first $15,000 of gifts to any person is excluded from tax. You would pay 10 percent on the first $9,875 of. However, this does not influence our evaluations. How do federal tax brackets work? Federal tax brackets 2020 declarations, daily updated news related to developments from irs, shortly, everything a taxpayer should know is here! 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Federal Capital Gains Tax Brackets 2020 Indeed recently has been sought by consumers around us, maybe one of you. People are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of the post I will discuss about Federal Capital Gains Tax Brackets 2020.

- What Were The Federal Tax Rates In 2016? | Capital Gains ... . Applying Federal Tax Rates To Your Situation.

- Low Tax Rates Provide Opportunity To “Cash Out” With ... . How To Bring Home $100,000 Tax Free.

- The New 2019 Federal Income Tax Brackets And Rates , How Do Federal Tax Brackets Work?

- The 2020 Federal Income Tax - Tax-Rates.org . Federal Income Tax Guide 2020 For 2019 Tax Preparation.

- Colorado Long Term Capital Gains Tax Rate - Tax Walls , But Performing This Calculation Can Be Instrumental In Helping You Find Strategies To Reduce To Complicate Things, Certain Investment Income Is Taxed At A Capital Gains Rate And Not At The Ordinary Income Rate.

- What Is The Real Value Of $100 In Your State? | Tax Foundation : 2020 Tax Brackets (Irs Federal Income Tax Rates Table).

- 2020 Capital Gains Tax Rates & How To Avoid A Big Bill ... : Do You Need To File A Tax Return?

- Your Guide To The 2020 U.s. Income Tax Brackets | Millionacres , As An Example, If You Are Single And Your Taxable Income Is $50,000, Your Tax.

- 2018 Taxes - Are You Going To Pay More Or Less In Taxes ... - It Also Depends On Other Sources Of Income (Such As Interest And Capital Gains) And Your.

- 2019 State Tax Due Dates Extensions List – Internal ... - Tax Rates In The U.s.

Find, Read, And Discover Federal Capital Gains Tax Brackets 2020, Such Us:

- 1031 Exchange North Carolina - Capital Gains Tax Rate 2020 : This Page Has The Latest Federal Brackets And Tax Rates, Plus A Federal Income Tax Calculator.

- T10-0171 - Current Policy To Current Law; Eliminate 10% ... : (See Irs Publications For 2013 2014 2015 2016 2017 2018 2019 2020.)

- Yogi And Associates . This Page Has The Latest Federal Brackets And Tax Rates, Plus A Federal Income Tax Calculator.

- Your 2020 Tax & Retirement Policy Guide | United Income : As An Example, If You Are Single And Your Taxable Income Is $50,000, Your Tax.

- State Corporate Income Tax Rates And Brackets For 2020 : Funds Will Become Taxable Only When They Are Distributed To You In Accordance With The Payout Plan Set Up For.

- 2020 Capital Gains Tax Rates & How To Avoid A Big Bill ... . As An Example, If You Are Single And Your Taxable Income Is $50,000, Your Tax.

- New York State Income Tax Tables 2017 | Www ... . Learn About What Capital Gains Tax Brackets Are And The Rates Associated With Them.

- Virginia Inheritance Tax Rate 2019 – Airheartmusic.com ... , In Other Words, If You Sell A Stock After Just A Few Months, Any Profit Will Be Treated No Differently Than Income From Your Job, As Far As Federal Income.

- Closing The Tax Gap, Improving The Tax Code Are ... : Let's Look At Each Of These To See How They Impact Your Tax Obligations.

- The Low Tax Rates Of Early Retirement – Mike Sandrik . How Do Federal Tax Brackets Work?

Federal Capital Gains Tax Brackets 2020 , Yogi And Associates

9 Home Buyer Tax Credits and Deductions for 2019, 2020. See how tax brackets work & how to cut your tax. The exclusion is increased to $157,000 for gifts to spouses who are not citizens of the. Our opinions are our own. 10%, 12%, 22%, 24%, 32%, 35% and 37%. You would pay 10 percent on the first $9,875 of. The federal tax brackets increases are highly dependent on the changes to the cost of living, changes to the tax system, and the inflation rate. 2020 capital gains tax rates (long term capital gains). How do federal tax brackets work? In 2020, the first $15,000 of gifts to any person is excluded from tax. However, this does not influence our evaluations. Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know let's use the tax bracket for 2020 and say your filing status is single and you earned $70,000. There are seven federal tax brackets for the 2020 tax year: 2020 tax brackets, tax foundation and irs topic number 559. Federal tax brackets 2020 declarations, daily updated news related to developments from irs, shortly, everything a taxpayer should know is here! Which federal income tax bracket are you in?

Federal income tax on the net total of all their capital gains.

How do federal tax brackets work? Do you need to file a tax return? However, this does not influence our evaluations. Federal income tax guide 2020 for 2019 tax preparation. See how tax brackets work & how to cut your tax. Our opinions are our own. Federal tax brackets 2020 declarations, daily updated news related to developments from irs, shortly, everything a taxpayer should know is here! All right everyone excited about this conversation we're gonna be talking about capital gains tax brackets… us tax brackets explained today i want to quickly address the u.s.federal tax brackets for individuals because they are fairly… In the united states of america, individuals and corporations pay u.s. Applying federal tax rates to your situation. Capital gains are investment gains. Assets include shares of stock, a piece of land, jewelry, coin collections, or a business. In 2020, the first $15,000 of gifts to any person is excluded from tax. To make matters more complicated, not every state. Let's look at each of these to see how they impact your tax obligations. It also depends on other sources of income (such as interest and capital gains) and your. Learn the australian income tax rates for 2019/20 and 2020/21, as well as details on how income tax is calculated the income tax brackets and rates for australian residents for this financial year are listed below. Federal income tax brackets are adjusted every year for inflation. You can see how these compare to the regular federal tax brackets here. Your top tax bracket doesn't just depend on your salary. Funds will become taxable only when they are distributed to you in accordance with the payout plan set up for. Marginal tax brackets refer to the tax imposed on the next dollar earned, which is a useful concept for tax planning because it enables income tax rate. Which federal income tax bracket are you in? (see irs publications for 2013 2014 2015 2016 2017 2018 2019 2020.) + made with an income of $500,000, you will owe 20% on your capital gains, so this sale of stock will add $10,000 to your overall federal tax bill. There are seven federal tax brackets for the 2020 tax year: 2020 federal income tax brackets. © provided by the motley fool 2021 federal tax brackets and tax rates. But performing this calculation can be instrumental in helping you find strategies to reduce to complicate things, certain investment income is taxed at a capital gains rate and not at the ordinary income rate. What are the new capital gains rates for 2020? Not all income is taxed according to the marginal tax brackets, and capital gains (income from when you.