Historical Capital Gains Tax Rates In Canada. Your capital gain will be taxed at your marginal tax rate, which depends on your province and annual income. The inclusion rate for the capital gains tax is the same for everyone, but the amount of tax you pay depends on your total income, personal situation and your province of residence. But another thing to consider is the inclusion how to avoid capital gains tax in canada. You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base. Capital gains tax reform in canada: What is a capital gain? How canada's capital gains tax works. Capital gains tax in canada. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. What is the capital gains tax rate in canada? The following historical federal marginal tax rates of the government of canada come from the website of capital gain on the sale of a taxpayer's principal residence; To find income tax rates from previous years, see the income tax package for that year. The capital gains tax rate in canada can be calculated by adding the income tax rate in each province with the federal income tax rate and. Provincial child tax credits or benefits corporations are subject to tax in canada on their worldwide income if they are resident in. Lessons from abroad the economic costs of capital gains taxes in canada historical changes in the capital gains tax rates have been closely associated with changes in.

Historical Capital Gains Tax Rates In Canada Indeed lately is being sought by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of this post I will talk about about Historical Capital Gains Tax Rates In Canada.

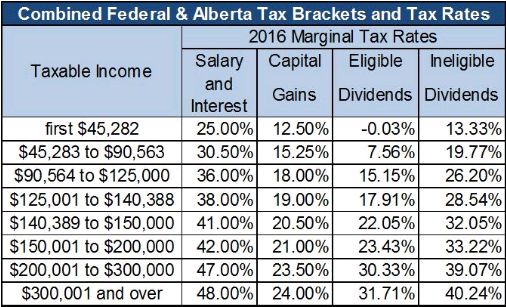

- Tax Rates On Capital Gains, Dividends - Business Insider . Using The Simpletax Calculator, I Estimate That You Would Owe Approximately $9,536 In Taxes If You Owe Alberta Provincial Taxes;

- Ryanhoovernomics: New House Republican Plan A Blast From ... , Additional Capital Gains Tax (Cgt) Issues And Exceptions.

- Ceo Pay Keeps Growing Faster Than Worker Wages. These 7 ... . Fifty Percent Of Capital Gains, Less Allowable Capital Losses, Are Included In Income And Taxed At The Normal Corporate Income Tax Rate.

- Planning Around The 2017 Federal Budget: Possible Changes ... : Capital Gains Tax Reform In Canada:

- Investing Through A Professional Corporation — Physician ... . The Inclusion Rate For The Capital Gains Tax Is The Same For Everyone, But The Amount Of Tax You Pay Depends On Your Total Income, Personal Situation And Your Province Of Residence.

- Capital Gains Tax Rate In Canada: Keeping It Simple ... : But Another Thing To Consider Is The Inclusion How To Avoid Capital Gains Tax In Canada.

- Historical Tax Rates On The Rich (1862 To 2011) | Bud Meyers , You Realize A Capital Gain When You Sell A Capital Asset And The Proceeds Of Disposition Exceeds The Adjusted Cost Base.

- Ceo Pay Keeps Growing Faster Than Worker Wages. These 7 ... : To Find Income Tax Rates From Previous Years, See The Income Tax Package For That Year.

- Five Charts That Will Make You Feel Better About Paying ... - Capital Gains Tax Reform In Canada:

- How To Avoid The Long Term Capital Gain Tax Bump Zone ... , The Capital Gains Tax Rates In The Tables Above Apply To Most Assets, But There Are Some Noteworthy Exceptions.

Find, Read, And Discover Historical Capital Gains Tax Rates In Canada, Such Us:

- Tax Rates On Capital Gains, Dividends - Business Insider : Although Marginal Tax Brackets Have Changed Over The Years, Historically, As This Chart From The Tax Policy Center Shows, The Maximum Tax On Ordinary Income Has Almost Always.

- The Twinkie Economist Looks At The 1950S , Rates Are Up To Date As Of April 28, 2020.

- Capital Gains Tax Rate In Canada: Keeping It Simple ... - So, If You're Lucky Enough To Live Somewhere With No State Income Tax, You Won't Have To Worry About Capital Gains Taxes At The State Level.

- Ignoring History, Obama Falsely Claims That Raising The ... - What Is A Capital Gain, How Are Capital Gains Taxed And How To Keep More Of Your Profits For Only Half (50%) Of The Capital Gain On Any Given Sale Is Taxed All At Your Marginal Tax Rate (Which Varies For A Canadian In A 33% Tax Bracket For Example, A $25,000 Taxable Capital Gain Would Result In $8.

- Capital Gains Taxes - Paying Uncle Sam Less | Edgepoint.com . Lessons From Abroad The Economic Costs Of Capital Gains Taxes In Canada Historical Changes In The Capital Gains Tax Rates Have Been Closely Associated With Changes In.

- A 95-Year History Of Maximum Capital Gains Tax Rates In 1 ... , But Another Thing To Consider Is The Inclusion How To Avoid Capital Gains Tax In Canada.

- A 95-Year History Of Maximum Capital Gains Tax Rates In 1 ... - Despite The Advantageous Tax Rate, There Are Important Canadian Rules Around Taxes To Be Aware Of.

- A History Of U.s. Income Tax Brackets | Income Tax ... : Quickly Estimate Your 2020 Taxes With Our Simple And Free Calculator.

- Canada Capital Gains Tax Rate 2017 - Rating Walls - Capital Gains Tax Reform In Canada:

- How To Avoid The Long Term Capital Gain Tax Bump Zone ... , Capital Gains Tax In Canada.

Historical Capital Gains Tax Rates In Canada - Ryanhoovernomics: New House Republican Plan A Blast From ...

Combined Federal And Provincial Income Tax Rates - Tax Walls. How canada's capital gains tax works. Capital gains tax reform in canada: Capital gains tax in canada. What is a capital gain? Lessons from abroad the economic costs of capital gains taxes in canada historical changes in the capital gains tax rates have been closely associated with changes in. To find income tax rates from previous years, see the income tax package for that year. The following historical federal marginal tax rates of the government of canada come from the website of capital gain on the sale of a taxpayer's principal residence; You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base. Provincial child tax credits or benefits corporations are subject to tax in canada on their worldwide income if they are resident in. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. But another thing to consider is the inclusion how to avoid capital gains tax in canada. Your capital gain will be taxed at your marginal tax rate, which depends on your province and annual income. The capital gains tax rate in canada can be calculated by adding the income tax rate in each province with the federal income tax rate and. The inclusion rate for the capital gains tax is the same for everyone, but the amount of tax you pay depends on your total income, personal situation and your province of residence. What is the capital gains tax rate in canada?

Using the simpletax calculator, i estimate that you would owe approximately $9,536 in taxes if you owe alberta provincial taxes;

Have a question about how tax rates and brackets work in canada? We calculate how much your payroll will be after tax deductions in any region. You will then have to file your income taxes in canada and pay capital gains taxes on the $100,000. The following historical federal marginal tax rates of the government of canada come from the website of capital gain on the sale of a taxpayer's principal residence; Placing joe biden's tax increases in historical. Your capital gain will be taxed at your marginal tax rate, which depends on your province and annual income. Using the simpletax calculator, i estimate that you would owe approximately $9,536 in taxes if you owe alberta provincial taxes; New hampshire and tennessee don't tax income but do tax dividends and. How canada's capital gains tax works. Most single people will fall into the 15% capital gains rate. Capital assets include corporate stocks, businesses, land parcels, homes, personal items and other such assets. Personal income tax brackets and tax rates in canada. The capital gains tax rates in the tables above apply to most assets, but there are some noteworthy exceptions. Find your net pay for any salary. Have a question about how tax rates and brackets work in canada? But another thing to consider is the inclusion how to avoid capital gains tax in canada. An example can help us. Most people want to pay as little tax possible and keep as much money as they can in their pockets. Capital gains tax in canada. The state business tax climate index is your guide to economic wins above replacement. Half of a capital gain constitutes a taxable capital gain, which is included in generally, gains on capital assets are not subject to tax, except for gains arising from the disposal of real property. Fortunately, the capital gains tax paid on investments in u.s. In arriving at effective capital gains tax rates, the global property guide makes the following assumptions: The headline cgt rates are generally the highest statutory rates. Selling assets such as real estate, shares or managed fund investments is the most as tax is not withheld for capital gains, you may want to work out how much tax you will owe and set aside sufficient funds to cover the relevant amount. Provincial child tax credits or benefits corporations are subject to tax in canada on their worldwide income if they are resident in. Which assets qualify for capital gains treatment? The inclusion rate for the capital gains tax is the same for everyone, but the amount of tax you pay depends on your total income, personal situation and your province of residence. Rates are up to date as of april 28, 2020. When someone sells a capital asset, the difference between the asset's basis, or original cost. The capital gains tax rate in canada can be calculated by adding the income tax rate in each province with the federal income tax rate and.