Long Term Capital Gains Tax Rates 2020. Remember, this isn't for the tax return you file in 2021, but rather, any gains you incur from january 1, 2021 to december 31, 2021. Quick and easy guide on capital gains. They are taxed at rates of 0%, 15%, or 20%, depending on the investor's. Long term capital gain brackets for 2020. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. In 2020 the capital gains tax rates are either 0%, 15% or 20% for. Guide to capital gains tax 2020 explains how cgt works and will help you to calculate your net capital gain or net capital loss. Comparing capital gains tax proposals by 2020 presidential candidates. How much these gains are taxed depends a lot on how long you held the asset before selling. Most single people will fall. If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs. It covers cgt issues such as the sale of a rental. Capital gains tax explains what a capital gain is, how it applies, what assets are included and the exceptions and exemptions. The actual rates didn't change for 2020, but the income brackets did adjust slightly. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains.

Long Term Capital Gains Tax Rates 2020 Indeed lately has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of this article I will talk about about Long Term Capital Gains Tax Rates 2020.

- What Is The Long Term Capital Gains Tax Rate For 2020 ... . Federal Income Tax On The Net Total Of All Their Capital Gains.

- Congress Should Reduce, Not Expand, Tax Breaks For Capital ... - Access The 2020 Tax Distributions For Blackrock Funds.

- T03-0094 - Tax Dividends And Long-Term Capital Gains At 15 ... . Albania (Last Reviewed 22 June 2020).

- How Does Budget 2020 Affect Long Term Capital Gains ... : How Much These Gains Are Taxed Depends A Lot On How Long You Held The Asset Before Selling.

- Long-Term Capital Gains Tax Rates In 2020 | The Motley Fool . There Are Also Special Cases When An Individual Is Charged At 10% On The Total Capital Gain;

- 2019-2020 Capital Gains Tax Brackets & Rates - Money Works ... : So, If You're Lucky Enough To Live Somewhere With No State Income Tax.

- Cryptocurrency Tax Guide (2020) | Cryptotrader.tax . Most Single People Will Fall.

- Short Term Vs Long Term Capital Gains Tax - 2020 - Youtube . Complete Guide To Tax Rates For 2020/21 Including Tax Brackets, National Insurance, Capital Gains Tax And More.

- Capital Gain Tax Rates By State - 2019 & 2020 : Calculate The Capital Gains Tax On A Sale Of Real Estate Property, Equipment, Stock, Mutual.

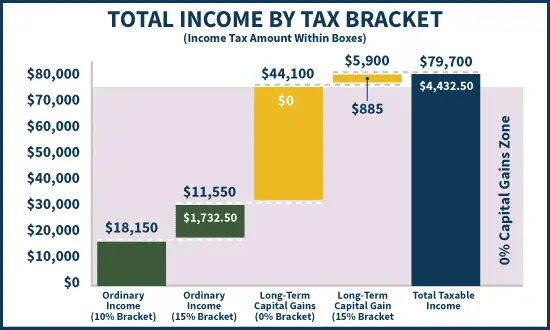

- Short Term Vs Long Term Capital Gains Tax - 2020 - Youtube , Let's Say That You're Married And That You And Your Spouse File A Joint Tax Return.

Find, Read, And Discover Long Term Capital Gains Tax Rates 2020, Such Us:

- Irs Releases 2020 Tax Rate Tables, Standard Deduction ... , Your Gains Are Not From Residential Property.

- How Roth Ira Conversions Can Escalate Capital Gains Taxes ... - There Are Also Special Cases When An Individual Is Charged At 10% On The Total Capital Gain;

- How To Use Mf, Stock Losses To Reduce Your Tax Burden (Tax ... . Access The 2020 Tax Distributions For Blackrock Funds.

- Short-Term And Long-Term Capital Gains Tax Rates By Income . Comparing Capital Gains Tax Proposals By 2020 Presidential Candidates.

- Income Tax And Capital Gains Rates 2017 - Skloff Financial ... , Capital Gains Tax Explains What A Capital Gain Is, How It Applies, What Assets Are Included And The Exceptions And Exemptions.

- What Is The Long Term Capital Gains Tax Rate For 2020 ... - In The United States Of America, Individuals And Corporations Pay U.s.

- Budget 2020: Markets Hope For Relaxation In Long-Term ... , Remember, This Isn't For The Tax Return You File In 2021, But Rather, Any Gains You Incur From January 1, 2021 To December 31, 2021.

- Profit Fund: 2017 , In 2020 The Capital Gains Tax Rates Are Either 0%, 15% Or 20% For.

- Consider Taxes In Your Investment Strategy | Rodgers ... . Most Single People Will Fall.

- T03-0080 - Tax Dividends And Long-Term Capital Gains At 15 ... - Comparing Capital Gains Tax Proposals By 2020 Presidential Candidates.

Long Term Capital Gains Tax Rates 2020 , The Mutual Funds Thread - Page 97 - Team-Bhp

WATCH: What is long term capital gains tax? | EXPLAINED .... It covers cgt issues such as the sale of a rental. They are taxed at rates of 0%, 15%, or 20%, depending on the investor's. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. Most single people will fall. If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs. How much these gains are taxed depends a lot on how long you held the asset before selling. Comparing capital gains tax proposals by 2020 presidential candidates. Long term capital gain brackets for 2020. The actual rates didn't change for 2020, but the income brackets did adjust slightly. Guide to capital gains tax 2020 explains how cgt works and will help you to calculate your net capital gain or net capital loss. Capital gains tax explains what a capital gain is, how it applies, what assets are included and the exceptions and exemptions. In 2020 the capital gains tax rates are either 0%, 15% or 20% for. Remember, this isn't for the tax return you file in 2021, but rather, any gains you incur from january 1, 2021 to december 31, 2021. Quick and easy guide on capital gains. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains.

Comparing capital gains tax proposals by 2020 presidential candidates.

They are taxed at rates of 0%, 15%, or 20%, depending on the investor's. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual. 3 2020 tax planning tables. Learn more about options for deferring capital gains taxes. Your gains are not from residential property. Guide to capital gains tax 2020 explains how cgt works and will help you to calculate your net capital gain or net capital loss. This allows couples to transfer a proportion of their personal allowance between them. It covers cgt issues such as the sale of a rental. They are taxed at rates of 0%, 15%, or 20%, depending on the investor's. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. 10 (on sale of equity shares/units of equity oriented funds in excess of inr 100,000); What capital gains tax (cgt) is, how to work it out, current cgt rates and how to pay. Access the 2020 tax distributions for blackrock funds. So, if you're lucky enough to live somewhere with no state income tax. Know about long term & short term capital assets, calculation, exemption & how to save tax on agricultural land. For the 2020/21 tax year, the marriage tax allowance remains at £1,250. Albania (last reviewed 22 june 2020). Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains. Most single people will fall. as amended by finance act, 2020. See our distributions page for a complete list of each fund's distribution frequency. If you can manage to hold your assets for longer than a year, you can. Capital gains tax long term vs short term. Individual capital gains tax rate (%). Not all capital gains are treated equally. Which rate your capital gains will be taxed depends on your taxable. The tax rate depends on both the investor's tax bracket and the. If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs. Let's say that you're married and that you and your spouse file a joint tax return. In 2020 the capital gains tax rates are either 0%, 15% or 20% for. How much these gains are taxed depends a lot on how long you held the asset before selling.