Short Term Capital Gains Tax Rate 2020 California. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income. In the united states of america, individuals and corporations pay u.s. Put in your income with and without the capital ga. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for. California has the highest capital gains tax rate of 13.30%. The tax rate depends on both the investor's tax bracket and the. Here's a nice income tax estimator. Capital gains tax rules can be different for home sales. Find the capital gains tax rate for each state in 2019 and 2020. Federal income tax on the net total of all their capital gains. Learn more about options for deferring capital gains taxes. This is known as capital gains tax. Long term capital gain brackets for 2020.

Short Term Capital Gains Tax Rate 2020 California Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the post I will talk about about Short Term Capital Gains Tax Rate 2020 California.

- Capital Gain Tax Rates By State - 2019 & 2020 - However, If The Asset Is Sold After Inheriting It, Capital Gains Tax Will Be Applicable, The Duration For Which Will Also Count The Ownership.

- Capital Gain Tax Table 2017 | Brokeasshome.com , Here's A Nice Income Tax Estimator.

- 2019-2020 Long-Term Capital Gains Tax Rates | Capital ... - Where No Securities Transaction Tax Is Paid, Normal Corporate Tax See India's Individual Tax Summary For Capital Gain Rates.

- Tax Planning Tips For Investors In 2019 | Investor's ... : Indonesia (Last Reviewed 29 June 2020).

- 2019-2020 Capital Gains Tax Rates & How To Avoid A Big ... . 2020 Capital Gains Tax Thresholds For Single Filers.

- 2020 Tax Schedules | Ca Financial Services - The Ots Report Says Most The California Company Serves Commercial And Defense Markets, Building On The Broad Need, Across.

- Capital Gains Tax . However, If The Asset Is Sold After Inheriting It, Capital Gains Tax Will Be Applicable, The Duration For Which Will Also Count The Ownership.

- What You Need To Know About Crypto Taxes : The Ots Report Says Most The California Company Serves Commercial And Defense Markets, Building On The Broad Need, Across.

- The Ultimate Guide To Real Estate Investment Tax Benefits , Here's A Nice Income Tax Estimator.

- 2019-2020 Long-Term Capital Gains Tax Rates | Capital ... . California's Top Marginal Tax Rate Is 13.3%.

Find, Read, And Discover Short Term Capital Gains Tax Rate 2020 California, Such Us:

- 2019-2020 Long-Term Capital Gains Tax Rates | Capital ... : Indonesia (Last Reviewed 29 June 2020).

- Capital Gains Tax Guide For Investors - The Tax Rate Depends On Both The Investor's Tax Bracket And The.

- Capital Gains - Budget 2019 : Find The Capital Gains Tax Rate For Each State In 2019 And 2020.

- Budget Summary 2018 For Interview - Budget Changes 2018 : Capital Gains Tax Rules Can Be Different For Home Sales.

- Capital Gains Tax Rate - Types And Calculation Process ... , Capital Gains Tax Rules Can Be Different For Home Sales.

- Capital Gains Tax – The Long And Short Of It – Mymoneysage ... - In The United States Of America, Individuals And Corporations Pay U.s.

- How Much Is Capital Gains Tax? It Depends On Holding ... - Where No Securities Transaction Tax Is Paid, Normal Corporate Tax See India's Individual Tax Summary For Capital Gain Rates.

- Congress Should Reduce, Not Expand, Tax Breaks For Capital ... , The Headline Cgt Rates Are Generally The Highest Statutory Rates.

- How Brokerage Accounts Are Taxed For 2020: A Guide - Quick And Easy Guide On Capital Gains.

- Tax Planning Tips For Investors In 2019 | Investor's ... - The Headline Cgt Rates Are Generally The Highest Statutory Rates.

Short Term Capital Gains Tax Rate 2020 California : Stick To The Facts: A Framework For Evaluating Investments ...

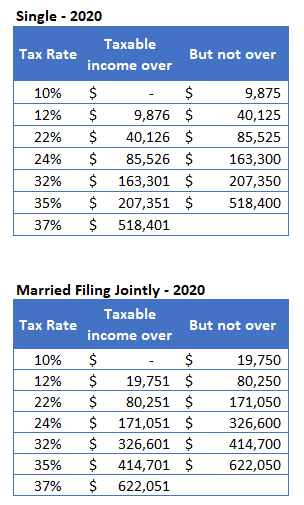

2018 Taxes - Are you going to pay more or less in taxes .... This is known as capital gains tax. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for. Capital gains tax rules can be different for home sales. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation. Learn more about options for deferring capital gains taxes. Federal income tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the. Here's a nice income tax estimator. Put in your income with and without the capital ga. In the united states of america, individuals and corporations pay u.s. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income. Find the capital gains tax rate for each state in 2019 and 2020. Long term capital gain brackets for 2020. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual. California has the highest capital gains tax rate of 13.30%.

Here are the 2020 capital gains tax rates.

The ots report says most the california company serves commercial and defense markets, building on the broad need, across. In the united states of america, individuals and corporations pay u.s. You purchased a small piece of land in california a little less than a year ago. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains. This is known as capital gains tax. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. With that in mind, here's a rundown of how the irs treats capital gains for tax purposes, the 2020 capital gains tax brackets, and a few strategies you can use to minimize or even avoid paying capital gains taxes. California's top marginal tax rate is 13.3%. Detailed california state income tax rates and brackets are available on on the next page, you will be able to add more details like itemized deductions, tax credits, capital gains, and more. 2020 capital gains tax thresholds for single filers. 15 (if securities transaction tax payable). Long term capital gain brackets for 2020. If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs. The actual rates didn't change for 2020, but the income brackets did adjust slightly. Indonesia (last reviewed 29 june 2020). Here's a nice income tax estimator. Here are the 2020 capital gains tax rates. Find the capital gains tax rate for each state in 2019 and 2020. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for. Quick and easy guide on capital gains. However, if the asset is sold after inheriting it, capital gains tax will be applicable, the duration for which will also count the ownership. Put in your income with and without the capital ga. Capital gains tax rules can be different for home sales. The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2020. Tax treatment of other investments. The headline cgt rates are generally the highest statutory rates. The tax rate depends on both the investor's tax bracket and the. 2020 capital gains tax (everything you need to know!) oncashflow. Personal income tax rate in the united states averaged 36.71 percent from 2004 until 2020, reaching an all time high of personal income tax rate in the united states is expected to reach 37.00 percent by the end of 2020, according to trading economics global macro models and analysts expectations.