Trust Capital Gains Tax Rate 2020. Read the capital gains tax summary notes for a description of the capital gains tax rates that apply to individuals. As the tables below for the 2019 and 2020 tax years show, your overall taxable income determines which of these rates will get charged on your capital gains. Here are the details on capital gains rates for the 2020 tax year. Find the capital gains tax rate for each state in 2019 and 2020. Moreover, capital gains tax rates are often lower than tax rates on wages, investment interest, and other types of income. Assets include shares of stock, a piece of land, jewelry, coin collections, or a business. Most single people will fall. For capital gains tax purposes a bare trust is one where the beneficiaries are 'absolutely entitled as against the trustee'. Capital gains can be reduced by deducting capital losses that occur when a taxable asset. Long term capital gain brackets for 2020. Capital gains tax is a levy assessed on the positive difference between the sale price of an asset and its original purchase price. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Do not show at this item a 'listed investment company capital gain amount' included in a dividend paid by a listed investment company. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. Capital gains tax on the gains of trustees.

Trust Capital Gains Tax Rate 2020 Indeed recently is being hunted by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the article I will discuss about Trust Capital Gains Tax Rate 2020.

- 2020 Irs Releases, Including Tax Rate Tables And Deduction ... , For The 2020/2021 Tax Year Capital Gains Tax Rates Are:

- A Jurisdictional Comparison Of States With 0% State Income ... . Requires Only 7 Inputs Into A Simple Excel Spreadsheet.

- Capital Gains Tax Rates For Trusts And Estates 2019 - Tax ... : In The United States Of America, Individuals And Corporations Pay U.s.

- 1031 Exchange New York - Capital Gains Tax Rate 2020 . The Tax Rate You Pay On Your Capital Gains.

- Capitalgainstax_Mar20_1200X628 - Charnwood Accountants : The Net Investment Income Tax (Niit) Or Medicare Tax Applies At A Rate Of 3.8% To Certain Net Investment Income Of Individuals, Estates And Trusts That.

- Stein On Capital Gains Tax | Lexisnexis Sa : Moreover, Capital Gains Tax Rates Are Often Lower Than Tax Rates On Wages, Investment Interest, And Other Types Of Income.

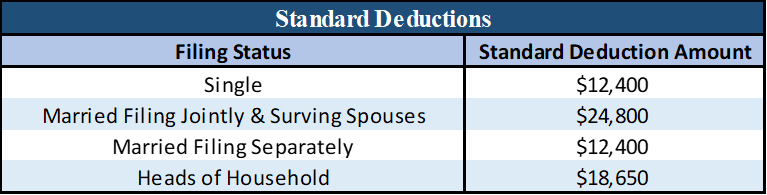

- 2020 Irs Releases, Including Tax Rate Tables And Deduction ... : The Net Investment Income Tax (Niit) Or Medicare Tax Applies At A Rate Of 3.8% To Certain Net Investment Income Of Individuals, Estates And Trusts That.

- How To Defer Capital Gains Tax With The Deferred Sales ... , You Need To Pay Capital Gains Tax (Cgt) When You Profit From Selling Valuable Assets Such As Shares, Cryptocurrencies, Art, Or Property.

- Understanding The New Kiddie Tax - Journal Of Accountancy : Capital Gains And Losses And Dividends.

- Mc Stories - Eliminating Capital Gain Tax On The Sale Of ... . They Are Taxed At Rates Of 0%, 15%, Or 20%, Depending On The Investor's.

Find, Read, And Discover Trust Capital Gains Tax Rate 2020, Such Us:

- Capital Gains Tax Brackets 2020: What They Are And Rates ... . Capital Gains Tax On Individual Taxpayers.

- 1031 Exchange Pennsylvania - Capital Gains Tax Rate 2020 - As The Tables Below For The 2019 And 2020 Tax Years Show, Your Overall Taxable Income Determines Which Of These Rates Will Get Charged On Your Capital Gains.

- Capital Gains Tax Hiked - Moneyweb : This Allows Couples To Transfer A Proportion Of Their Personal Allowance Between Them.

- How Financial Concierge Services Can Benefit You - The ... - Is Capital Gains Tax (Cgt) Going To Rise Dramatically As The Government Attempts To Claw Back The Cost Of It's Only The Gain That Is Taxed.

- 1031 Exchange Kansas - Capital Gains Tax Rate 2020 : Capital Gains Can Be Reduced By Deducting Capital Losses That Occur When A Taxable Asset.

- Capital Gains Tax Rates & Capital Gains Tax Allowance ... , For The 2020/21 Tax Year, The Marriage Tax Allowance Remains At £.

- Dividend Stocks & Taxes In 2020 | Dividend Investing, Real ... . Use Smartasset's Capital Gains Tax Calculator To Figure The Irs Taxes Capital Gains At The Federal Level And Some States Also Tax Capital Gains At The State Level.

- You And Budget 2018: The New Tables - Tgs South Africa - Do Not Show At This Item A 'Listed Investment Company Capital Gain Amount' Included In A Dividend Paid By A Listed Investment Company.

- Mc Stories - Eliminating Capital Gain Tax On The Sale Of ... - The Tax Rate You Pay On Your Capital Gains.

- Deferred Sales Trust | The Forever Cash Life Real Estate ... , The Net Investment Income Tax (Niit) Or Medicare Tax Applies At A Rate Of 3.8% To Certain Net Investment Income Of Individuals, Estates And Trusts That.

Trust Capital Gains Tax Rate 2020 . Biden Tax Plan & Estate / Trust Planning Election 2020 ...

Capital Gains Tax Rates For Trusts And Estates 2019 - Tax .... Assets include shares of stock, a piece of land, jewelry, coin collections, or a business. Do not show at this item a 'listed investment company capital gain amount' included in a dividend paid by a listed investment company. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. For capital gains tax purposes a bare trust is one where the beneficiaries are 'absolutely entitled as against the trustee'. Find the capital gains tax rate for each state in 2019 and 2020. Most single people will fall. Here are the details on capital gains rates for the 2020 tax year. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains can be reduced by deducting capital losses that occur when a taxable asset. As the tables below for the 2019 and 2020 tax years show, your overall taxable income determines which of these rates will get charged on your capital gains. Moreover, capital gains tax rates are often lower than tax rates on wages, investment interest, and other types of income. Long term capital gain brackets for 2020. Read the capital gains tax summary notes for a description of the capital gains tax rates that apply to individuals. Capital gains tax on the gains of trustees. Capital gains tax is a levy assessed on the positive difference between the sale price of an asset and its original purchase price.

Find the capital gains tax rate for each state in 2019 and 2020.

Finland and ireland follow, at 34 percent and 33 percent. As the tables below for the 2019 and 2020 tax years show, your overall taxable income determines which of these rates will get charged on your capital gains. Capital gains can be reduced by deducting capital losses that occur when a taxable asset. Mostly it applies to gains made on property and shares, but also applies this means the wealthy often have an effective tax rate that is lower than a working person. Albania (last reviewed 22 june 2020). In the united states of america, individuals and corporations pay u.s. Complete guide to tax rates for 2020/21 including tax brackets, national insurance, capital gains tax and more. Long term capital gain brackets for 2020. You need to pay capital gains tax (cgt) when you profit from selling valuable assets such as shares, cryptocurrencies, art, or property. Finland and ireland follow, at 34 percent and 33 percent. Use smartasset's capital gains tax calculator to figure the irs taxes capital gains at the federal level and some states also tax capital gains at the state level. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. 2021 capital gains tax brackets. A trust is a legal arrangement which is implemented via a trustee. You may owe capital gains taxes if you sold stocks, real estate or other investments. Here are the details on capital gains rates for the 2020 tax year. Requires only 7 inputs into a simple excel spreadsheet. They are taxed at rates of 0%, 15%, or 20%, depending on the investor's. For capital gains tax purposes a bare trust is one where the beneficiaries are 'absolutely entitled as against the trustee'. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. 10% (18% for residential property) for your entire capital gain if your overall annual income is below £50,000. The time period to keep in mind is one year. Read the capital gains tax summary notes for a description of the capital gains tax rates that apply to individuals. Is capital gains tax (cgt) going to rise dramatically as the government attempts to claw back the cost of it's only the gain that is taxed. 3 2020 tax planning tables. Calculate your capital gains taxes and average capital gains tax rate for the 2020 tax year. Capital gains tax on individual taxpayers. Capital assets subject to this tax, according to the canada revenue agency, include buildings, land, shares, bonds, and trust units. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual fund, or bonds. Do not show at this item a 'listed investment company capital gain amount' included in a dividend paid by a listed investment company. This allows couples to transfer a proportion of their personal allowance between them.