Us Capital Gains Tax Rate History. Federal income tax on the net total of all their capital gains. The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). Capital gains taxes were enacted in 1913, along with the income tax. (not sure what tax bracket you're in? In addition, taxpayers face state and local capital gains tax rates between zero and capital gains taxes represent an additional tax on a dollar of income that has already been taxed multiple times. Tax rates heavily influence investor behavior and therefore where the money flows and which asset types have better or worse relative performance. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate. History is full of tax rebellions. The tax rate depends on both the investor's tax bracket and the. Back in 1773, taxes sparked americans to destroy three shiploads of british tea. How capital gains tax rates are calculated today. However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate. In any event, you may find it useful to review the history of dividend and capital gains tax treatment since income taxes were instituted in the us in. In the united states of america, individuals and corporations pay u.s.

Us Capital Gains Tax Rate History Indeed lately has been hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this post I will talk about about Us Capital Gains Tax Rate History.

- Capital Gain Tax Table | Brokeasshome.com . In The United States Of America, Individuals And Corporations Pay U.s.

- Capital Gains Tax: Ontario Capital Gains Tax Rate , Capital Gain If The Amount Of Money And Property You Received, Or Were Entitled To Receive, From The Cgt Event Was More Than The Cost Base Of Your Asset Capital Gains You Have At The Managed Fund Distributions Section.

- Bea: Personal Income Drops 3.6 Percent In January, The ... : Capital Gains Tax Rate History.

- Who Pays U.s. Income Tax, And How Much? : Economics , Most States Tax Capital Gains According To The Same Tax Rates They Use For Regular Income.

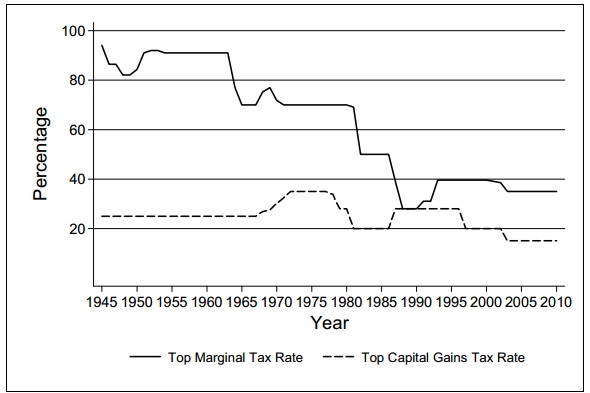

- Fluctuations In Top Tax Rates: 1910 To Today ... : Capital Gains Tax Rates On Most Assets Held For Less Than A Year Correspond To Ordinary Income Tax Brackets (10%, 12%, 22%, 24%, 32%, 35% Or 37%).

- For The First Time In History, U.s. Billionaires Paid A ... - In The United States Of America, Individuals And Corporations Pay U.s.

- What Lower Tax Rates Would (And Would Not) Mean For The U ... - What Capital Gains Tax (Cgt) Is, How To Work It Out, Current Cgt Rates And How To Pay.

- Tax Rates On Capital Gains, Dividends - Business Insider . Capital Gains Tax Has A Long And Complex History.

- 2018 Capital Gains Tax Rates Breakdown - Rating Walls , Learn More About Options For Deferring Capital Gains Taxes.

- State Spirits Excise Tax Rates 2013 | Map, Tax Rate ... - And In 1791, Alexander Hamilton's Proposed Excise Tax On Alcohol Was Enough To Prompt The Whiskey.

Find, Read, And Discover Us Capital Gains Tax Rate History, Such Us:

- Unit 10: The Influence Of Government Taxes And Regulations ... : But We Do Have To Make Money To Pay Our Team And Keep This.

- The Nordics Use Optimal Tax Theory To Fund Their Welfare ... - In Addition, Taxpayers Face State And Local Capital Gains Tax Rates Between Zero And Capital Gains Taxes Represent An Additional Tax On A Dollar Of Income That Has Already Been Taxed Multiple Times.

- Income Tax In The United States - Wikipedia : Capital Gains Taxes Are The Taxes You Pay On Profits From Most Investments, Including Stocks, Bonds, Or Mutual Funds.

- A Starting Point For Tax Reform: What Reagan Did - The New ... - Tax Rates Heavily Influence Investor Behavior And Therefore Where The Money Flows And Which Asset Types Have Better Or Worse Relative Performance.

- Second Machine Age Or Fifth Technological Revolution ... : We Will Discuss The Chapter On 'Capital Gains' Here.

- A History Of U.s. Income Tax Brackets | Income Tax ... : History Is Full Of Tax Rebellions.

- Tax Rates On Capital Gains, Dividends - Business Insider , Some States Also Levy Taxes On Capital Gains.

- File:maximum Federal Tax Rate On Long Term Capital Gains ... , Journey Through The Time — From The Stone Age To The Space Age — And Develop An Empire.

- U.s. Dividend, Cap Gains Tax Rate History: Possible ... : Our Goal Is To Help You Make Smarter Financial Decisions By Providing You With.

- Ryanhoovernomics: New House Republican Plan A Blast From ... - Capital Loss Carryovers Are Reported Using The Capital Gains Carryover Worksheet.

Us Capital Gains Tax Rate History , For The First Time In History, U.s. Billionaires Paid A ...

A Starting Point for Tax Reform: What Reagan Did - The New .... Capital gains taxes were enacted in 1913, along with the income tax. In the united states of america, individuals and corporations pay u.s. However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). The tax rate depends on both the investor's tax bracket and the. The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. Back in 1773, taxes sparked americans to destroy three shiploads of british tea. Tax rates heavily influence investor behavior and therefore where the money flows and which asset types have better or worse relative performance. How capital gains tax rates are calculated today. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate. (not sure what tax bracket you're in? Federal income tax on the net total of all their capital gains. In addition, taxpayers face state and local capital gains tax rates between zero and capital gains taxes represent an additional tax on a dollar of income that has already been taxed multiple times. History is full of tax rebellions. In any event, you may find it useful to review the history of dividend and capital gains tax treatment since income taxes were instituted in the us in.

Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%).

From a tax perspective, it usually makes sense to hold onto investments for more than a year. Gains on art and collectibles are taxed at ordinary income tax rates up to a maximum rate of. Our information will help you better understand potential liabilities. A capital gains tax is a tax levied on the profit gleaned from the sale of a capital asset. Capital gains tax (cgt) is a term you'll often hear as tax time draws near. Federal income tax on the net total of all their capital gains. We've got all the 2019 and 2020 capital gains tax rates in one place. Shares or real estate disposal information provided to us. But we do have to make money to pay our team and keep this. Journey through the time — from the stone age to the space age — and develop an empire. Learn about what capital gains tax brackets are and the rates associated with them. The headline cgt rates are generally the highest statutory rates. When someone sells a capital asset, the difference between the asset's basis, or original cost. For the 2020 to 2021 tax year help us improve gov.uk. We discuss the treatment of dividends and capital gains, investment losses, and more. However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate. And a good way to be organised is to keep up to date. Capital gains are not applicable to an inherited property as there is no sale, only a transfer of. Basically, if you buy shares, property, or other assets for one price and sell them for another price, the difference between. Biden has proposed increasing the top tax rate for capital gains for the highest earners to 39.6% from 23.8%, the largest real increase in capital gains rates in history. In addition, taxpayers face state and local capital gains tax rates between zero and capital gains taxes represent an additional tax on a dollar of income that has already been taxed multiple times. Need to figure out your capital gains tax liability on a sale of an asset? Some states also levy taxes on capital gains. And in 1791, alexander hamilton's proposed excise tax on alcohol was enough to prompt the whiskey. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. (not sure what tax bracket you're in? In the united states of america, individuals and corporations pay u.s. From a tax perspective, it usually makes sense to hold onto investments for more than a year. Over time, that will move more people into higher tax brackets. History is full of tax rebellions. So, if you're lucky enough to live somewhere with no state income tax, you won't have to worry about capital gains taxes at the state level.