Capital Gains Tax Chart 2019. The capital gains tax rates are determined based on the residential status of an individual / investor. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). This measure increases the capital gains tax annual exempt amount to £12,000 for individuals and personal representatives and £6,000 for trustees of settlements for the period 2019 to 2020. We've got all the 2019 and 2020 capital gains tax rates in one place. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350. Capital gains and dividends taxes. Need to figure out your capital. Realized does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Cash in 0 capital gains tax rate hallmark accountants llc, data visualization visual guide for understanding marginal, 55 info 2018 tax brackets on capital gains 2019, california capital gains rate table, projected 2019 tax rates brackets standard deduction. While capital gains taxes can be annoying, some of the best investments, such as stocks, allow you to skip the taxes on your gains as long as you don't realize those gains by exiting the position. Find the capital gains tax rate for each state in 2019 and 2020. These mytax 2019 instructions are about capital gains tax events, capital gains (income) and capital losses. Learn more about options for deferring capital gains taxes. For most cgt events, you make a

Capital Gains Tax Chart 2019 Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this article I will talk about about Capital Gains Tax Chart 2019.

- Capital Gains Tax Brackets 2019: What They Are And Rates , The State Would Apply A 9 Percent Tax To Capital Gains Earnings Above $25,000 For Individuals And $50,000 For Joint Filers.

- Real Estate Tax Benefits - The Ultimate Guide . Collectible Long Term Capital Gains Rate.

- Download Excel Based – Income Tax Calculator For Fy 2019 ... : The Capital Gains Tax Rates Are Determined Based On The Residential Status Of An Individual / Investor.

- Mutual Funds Capital Gains Taxation Rules Fy 2018-19 / Ay ... , Introduction Capital Gains Tax Corporate Tax Personal Income Tax Withholding Tax Value Added Tax Tax Procedures Excise Duties Miscellaneous The Measure The Bill Seeks To Increase The Capital Gains Tax (Cgt) Rate From The Current 5% To 12.5%.

- Mutual Funds Capital Gains Taxation Rules Fy 2018-19 / Ay ... - It Relies On The Fact That Money You Lose On An Investment Can Offset Your Capital Gains On Other Investments.

- What Is The Long-Term Capital Gains Tax Rate? - Bankrate.com - The Capital Gains Tax Rates Are Determined Based On The Residential Status Of An Individual / Investor.

- A Programmer Tries To Figure Out How Capital Gains Tax ... - The Following Chart Shows The Breakpoints For 2019 Based On Your Filing Status And Taxable Income

- Is Tax-Loss Harvesting Worth It? | The Ultimate Guide ... - Introduction Capital Gains Tax Corporate Tax Personal Income Tax Withholding Tax Value Added Tax Tax Procedures Excise Duties Miscellaneous The Measure The Bill Seeks To Increase The Capital Gains Tax (Cgt) Rate From The Current 5% To 12.5%.

- Income Tax Calculator Ay 2019-20 Fy 2018-19 - Youtube , Find The Capital Gains Tax Rate For Each State In 2019 And 2020.

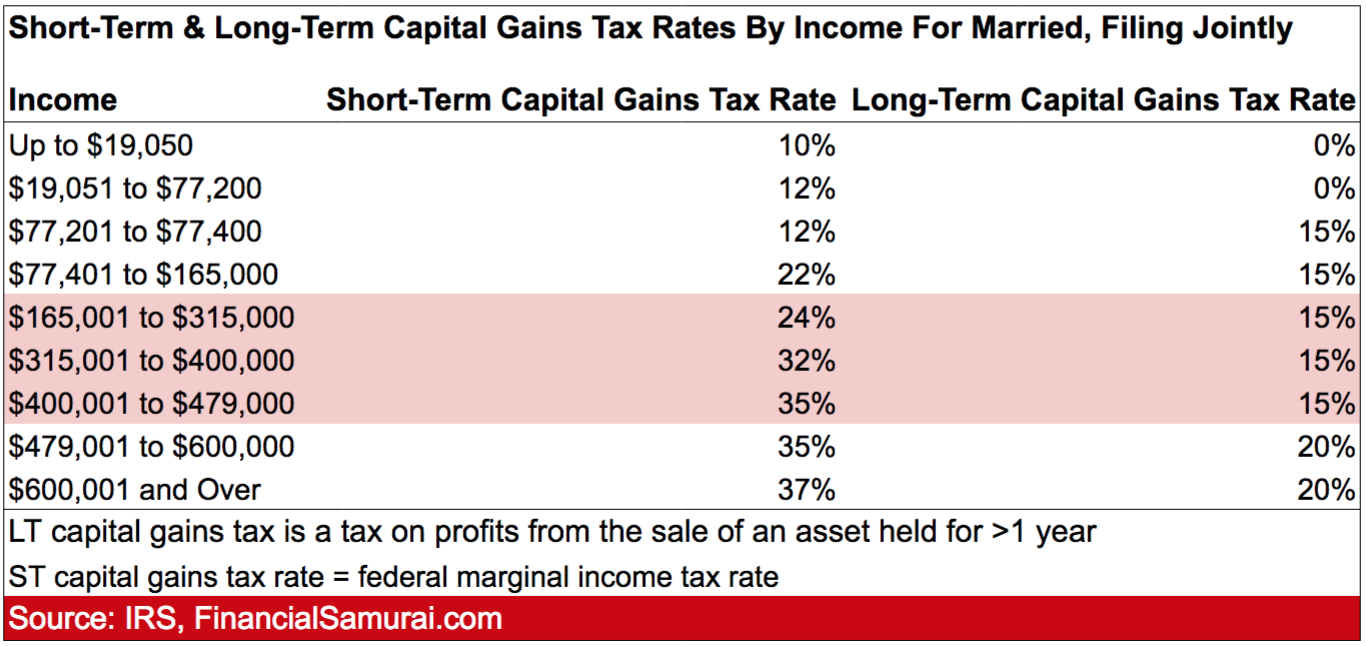

- Short-Term And Long-Term Capital Gains Tax Rates By Income . Covering Easy To Understand Definition, Short Term, Long Term, Its Classification Along With Stcg, Ltcg Tax Rates, Cost Of Inflation Income From Capital Gains Is Classified As Short Term Capital Gains And Long Term Capital Gains.

Find, Read, And Discover Capital Gains Tax Chart 2019, Such Us:

- Ambulatory Surgery Center Income Taxes & The Tax Cut ... . Betting And Gaming Levy (B&Gl).

- Maryland Tax Tables 2018 | Brokeasshome.com : This Chart Has Been Prepared For General Guidance On Matters Of Interest Only, And Does Not.

- 2019 - 2020 Capital Gains Tax Rates - Go Curry Cracker! . Collectible Long Term Capital Gains Rate.

- Cost Of Inflation Index Fy 2019-20 Ay 2020-21 For Capital ... - The Top Marginal Income Tax Rate Of 37 Percent Will Hit Taxpayers With Taxable Income Of $510,300 And Higher For Single Filers And $612,350.

- Hmrc Buy To Let Property Capital Gains Tax Calculator 2019 ... - It Relies On The Fact That Money You Lose On An Investment Can Offset Your Capital Gains On Other Investments.

- The Fear Of Running Out Of Money In Retirement Is Overblown . Cash In 0 Capital Gains Tax Rate Hallmark Accountants Llc, Data Visualization Visual Guide For Understanding Marginal, 55 Info 2018 Tax Brackets On Capital Gains 2019, California Capital Gains Rate Table, Projected 2019 Tax Rates Brackets Standard Deduction.

- Ordinary Dividends, Qualified Dividends, Return Of Capital ... , In Simple Terms, Capital Gains Tax Is Payable On The Disposal Of An Asset.

- Simpletax: 2019 Canadian Income Tax Calculator - Federal Income Tax On The Net Total Of All Their Capital Gains.

- Long Term Capital Gains Tax Table 2017 | Elcho Table . The Tax Rate Depends On Both The Investor's Tax Bracket And The Amount.

- 2019 - 2020 Capital Gains Tax Rates - Go Curry Cracker! . Federal Income Tax On The Net Total Of All Their Capital Gains.

Capital Gains Tax Chart 2019 - Capital Gains Rates Before And After The New Tax Law | Kwc ...

Tax On Mutual Funds FY 2019-20. The capital gains tax rates are determined based on the residential status of an individual / investor. Capital gains and dividends taxes. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350. Find the capital gains tax rate for each state in 2019 and 2020. This measure increases the capital gains tax annual exempt amount to £12,000 for individuals and personal representatives and £6,000 for trustees of settlements for the period 2019 to 2020. For most cgt events, you make a Need to figure out your capital. Realized does not offer legal or tax advice. Cash in 0 capital gains tax rate hallmark accountants llc, data visualization visual guide for understanding marginal, 55 info 2018 tax brackets on capital gains 2019, california capital gains rate table, projected 2019 tax rates brackets standard deduction. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). Learn more about options for deferring capital gains taxes. We've got all the 2019 and 2020 capital gains tax rates in one place. While capital gains taxes can be annoying, some of the best investments, such as stocks, allow you to skip the taxes on your gains as long as you don't realize those gains by exiting the position. Please consult the appropriate professional regarding your individual circumstance. These mytax 2019 instructions are about capital gains tax events, capital gains (income) and capital losses.

You may owe capital gains taxes if you sold stocks, real estate or other investments.

2019 capital gains tax brackets. This chart has been prepared for general guidance on matters of interest only, and does not. These mytax 2019 instructions are about capital gains tax events, capital gains (income) and capital losses. 2021 capital gains tax brackets. You may owe capital gains taxes if you sold stocks, real estate or other investments. In this video we explain capital gains tax (cgt). How to calculate fair market value of the property. This measure increases the capital gains tax annual exempt amount to £12,000 for individuals and personal representatives and £6,000 for trustees of settlements for the period 2019 to 2020. In simple terms, capital gains tax is payable on the disposal of an asset. Cash in 0 capital gains tax rate hallmark accountants llc, data visualization visual guide for understanding marginal, 55 info 2018 tax brackets on capital gains 2019, california capital gains rate table, projected 2019 tax rates brackets standard deduction. Every year, income tax department notifies cost inflation index. The time period to keep in mind is one year. Federal income tax on the net total of all their capital gains. They are taxed at rates of 0%, 15%, or 20%, depending on the investor's. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. Capital gains tax is when you sell an asset or an investment for more than you paid for it. The following chart shows the breakpoints for 2019 based on your filing status and taxable income The capital gains tax rates are determined based on the residential status of an individual / investor. The tax rate depends on both the investor's tax bracket and the amount. A capital gain occurs when you sell an asset for more than you paid for tax purposes, it's useful to understand the difference between realized gains and unrealized gains. Betting and gaming levy (b&gl). The state would apply a 9 percent tax to capital gains earnings above $25,000 for individuals and $50,000 for joint filers. For most cgt events, you make a In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). Cost inflation index is used for calculating long term capital gain. How to calculate capital gains using cii. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation income from capital gains is classified as short term capital gains and long term capital gains. Realized does not offer legal or tax advice. Capital gains are subject to the normal cit rate. Calculate your 2019 federal tax liability on ordinary income using these tax bracket charts. Please consult the appropriate professional regarding your individual circumstance.