Long Term Capital Gains Tax Rates Married Filing Jointly. Single, married and filing jointly, head of household, and married and filing separately. Capital gains tax rates by income for married couples. Married filing jointly impacts your tax rate. The married filing jointly filing status provides more tax benefits than filing separate returns you can live apart as long as a court hasn't issued an order governing the terms of your separation. Married filing jointly tax brackets (& surviving spouses). The income thresholds depend on the filer's status (individual, married filing jointly, etc.). Married filing jointly or qualified widow(er). Once you hold your investments for longer than a year, the the rate for $425,801 or more is 20%. If you're married and file jointly, the largest tax. What is the capital gains tax rate? A taxpayer's filing status determines which standard. The amount of taxes paid is based on income. Capital gains do not push ordinary income into a higher income bracket. Let's say that you're married and that you and your spouse file. Which rate your capital gains will be taxed depends on your taxable income, and filing status (aka single, married and filing separately, married and filing jointly or head of household).

Long Term Capital Gains Tax Rates Married Filing Jointly Indeed recently is being hunted by consumers around us, maybe one of you personally. People are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the post I will discuss about Long Term Capital Gains Tax Rates Married Filing Jointly.

- The New Tax Law - Wj Interests | Wealth Advisors In Sugar ... - The Married Filing Jointly Filing Status Provides More Tax Benefits Than Filing Separate Returns You Can Live Apart As Long As A Court Hasn't Issued An Order Governing The Terms Of Your Separation.

- Gauge Your Tax Bracket To Drive Tax Planning At Year-End ... - An Individual Earning More Than $510,300 Qualifies For The Top Rate.

- Average Federal Tax Rates By Income Quintile - Econlib . Which Rate Your Capital Gains Will Be Taxed Depends On Your Taxable Income, And Filing Status (Aka Single, Married And Filing Separately, Married And Filing Jointly Or Head Of Household).

- Cash In On 0% Capital Gains Tax Rate | Peter Diamond . Single, Married And Filing Jointly, Married And Filing Separately, And Head Of Household.

- 2018 Cryptocurrency Tax Rules - The Cryptocurrency Forums , Single People Are Able To Exclude Up To $250,000 Of Their Capital Gain, And Married Couples Who File Jointly May Exclude Up To $500,000 Of Their Gain.

- Who Pays The Taxes? - British Expats - For Married Couples Filing Jointly, You Must File A Joint Tax Return, And One Spouse Needs To Have Owned The Property For A Minimum Of Five Years, With Both Spouses Living In The.

- Taxes Resources | Bankrate.com : Sanders' Plan Taxes Capital Gains At The Same Rate As Ordinary Income For Taxpayers With Income Of $250,000 And Above.

- Bbf Capital Gains Presentation . The Same Table For Married, Filing Jointly Taxpayers Appears Below.

- A Taxable Account Isn't Actually That Bad - Live Free Md : Here Is The Capital Gains Tax Rate For 2019, Both For Long Term And Short Term Holdings.

- Tax Resolution Services – We Help Solving Irs Tax Problems . You Pay This Tax If Your Modified Adjusted Gross Income Is $200,000 Or More ($250,000 If Filing Jointly, Or $125,000 If Married Filing Separately).

Find, Read, And Discover Long Term Capital Gains Tax Rates Married Filing Jointly, Such Us:

- A Taxable Account Isn't Actually That Bad - Live Free Md : Capital Gains Tax Rates By Income For Married Couples.

- B. What Is The Comers' Tax Liability For 2019 If T ... - Single People Are Able To Exclude Up To $250,000 Of Their Capital Gain, And Married Couples Who File Jointly May Exclude Up To $500,000 Of Their Gain.

- New Tax Reform Changes – Whiteside & Simms – New Orleans ... : Where The Capital Gains Tax (Cgt) Asset To Which The Transaction Relates Is Taxable Australian Real Property Or An Indirect Australian Real Property Company Title Interest, The Entity Is Treated As A Relevant Foreign Resident Unless A Clearance Certificate Is Obtained From Us Certifying That The Entity Is Not A.

- How To Know If Zero Percent Capital Gains Tax Rate Can Be ... - Single People Are Able To Exclude Up To $250,000 Of Their Capital Gain, And Married Couples Who File Jointly May Exclude Up To $500,000 Of Their Gain.

- 2013 Capital Gains Tax Table – Marotta On Money , Capital Gains Do Not Push Ordinary Income Into A Higher Income Bracket.

- Restricted Stock Unit (Rsus) Strategy Guide * Level Up ... , Kept The Asset For Longer Than One Year.

- Average Federal Tax Rates By Income Quintile - Econlib : An Individual Earning More Than $510,300 Qualifies For The Top Rate.

- Federal Tax Brackets For Married Filing Jointly - Tax Walls : The Brackets Adjusted Slightly Upwards For 2021.

- Nam Tai Property: Please Stop Issuing A Dividend - Nam Tai ... , For Long Term Capital Gains, They Are Normally Taxed At A Rate That Is Lower Than Your Ordinary Income Tax Rate.

- The Tax Cuts And Jobs Act Of 2017 | Lathrop Gage - Jdsupra , Single, Married And Filing Jointly, Head Of Household, And Married And Filing Separately.

Long Term Capital Gains Tax Rates Married Filing Jointly . Why Tax-Efficient Investing Is Extremely Powerful ...

Who Pays The Taxes? - British Expats. The amount of taxes paid is based on income. What is the capital gains tax rate? Married filing jointly or qualified widow(er). The income thresholds depend on the filer's status (individual, married filing jointly, etc.). If you're married and file jointly, the largest tax. Married filing jointly tax brackets (& surviving spouses). Single, married and filing jointly, head of household, and married and filing separately. Let's say that you're married and that you and your spouse file. Married filing jointly impacts your tax rate. Once you hold your investments for longer than a year, the the rate for $425,801 or more is 20%. Which rate your capital gains will be taxed depends on your taxable income, and filing status (aka single, married and filing separately, married and filing jointly or head of household). The married filing jointly filing status provides more tax benefits than filing separate returns you can live apart as long as a court hasn't issued an order governing the terms of your separation. Capital gains do not push ordinary income into a higher income bracket. Capital gains tax rates by income for married couples. A taxpayer's filing status determines which standard.

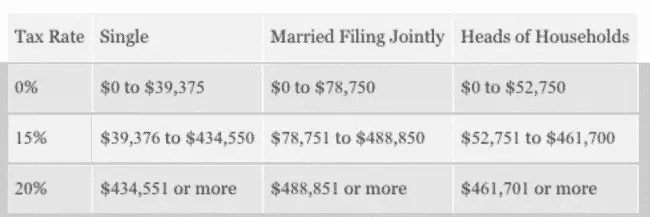

The same table for married, filing jointly taxpayers appears below.

Let's say that you're married and that you and your spouse file. How long do you have to live in your home before selling it in order to claim the capital gains exclusion? Kept the asset for longer than one year. The brackets adjusted slightly upwards for 2021. For married couples filing jointly, you must file a joint tax return, and one spouse needs to have owned the property for a minimum of five years, with both spouses living in the. What is the capital gains tax rate? Single people are able to exclude up to $250,000 of their capital gain, and married couples who file jointly may exclude up to $500,000 of their gain. The amount of taxes paid is based on income. A taxpayer's filing status determines which standard. Here is the capital gains tax rate for 2019, both for long term and short term holdings. For long term capital gains, they are normally taxed at a rate that is lower than your ordinary income tax rate. Married filing jointly or qualified widow(er). $488,850 for married filing jointly or. How much may a married couple filing jointly exclude from capital gains on the qualified sale of their primary home? Married filing jointly tax brackets (& surviving spouses). From capital gains to property taxes to transfer taxes, real estate taxes when you sell a home can cost a pretty penny. There are four filing categories: You pay this tax if your modified adjusted gross income is $200,000 or more ($250,000 if filing jointly, or $125,000 if married filing separately). Married filing jointly impacts your tax rate. The same table for married, filing jointly taxpayers appears below. Sanders' plan taxes capital gains at the same rate as ordinary income for taxpayers with income of $250,000 and above. Single, married and filing jointly, head of household, and married and filing separately. Once you hold your investments for longer than a year, the the rate for $425,801 or more is 20%. 0% if your income is below $37,950 and you are filing as single (or below $75,900 for married filing jointly). Where the capital gains tax (cgt) asset to which the transaction relates is taxable australian real property or an indirect australian real property company title interest, the entity is treated as a relevant foreign resident unless a clearance certificate is obtained from us certifying that the entity is not a. The tables below summarize both personal income tax and capital gains tax rates for single individuals and married couples filing jointly in. You don't need to pay up to $250,000 ($500,000 for married couples filing jointly) in capital gains on your home sale if you meet three conditions A guide to tax impact on income from capital gains. An individual earning more than $510,300 qualifies for the top rate. Earned more from the sale of a capital asset than your basis in the asset. Single, married and filing jointly, married and filing separately, and head of household.