Long Term Capital Gains Tax Rates Usa. The capital gains tax is one of many taxes. The tax rate on most net capital gain is no higher than 15% for most individuals. Headline rates for wwts territories. In other words, if you sell a stock after just a few months, any profit will be treated no differently than income from your job, as far as federal income tax. Long term capital gain brackets for 2020. The tax rate depends on both the investor's tax bracket and the. The headline cgt rates are generally the highest statutory rates. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. 10 (on sale of equity shares/units of equity oriented funds in excess of inr capital gains are subject to the normal pit rate, except for sale of land and buildings and. Let's say that you're married and that you and your spouse file a joint tax return. Federal income tax on the net total of all their capital gains. In the united states of america, individuals and corporations pay u.s. All capital gains and any capital losses are required to be reported on your tax return. In addition, taxpayers face state and local capital even taxpayers in states without taxes on capital gains face top rates higher than the oecd average. The capital gains tax rates in the tables above apply to most assets, but there are some noteworthy exceptions.

Long Term Capital Gains Tax Rates Usa Indeed recently is being hunted by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of this post I will discuss about Long Term Capital Gains Tax Rates Usa.

- Dividend Tax Rate And Long-Term Capital Gains Tax Rate: U ... , Capital Gains Tax (Cgt) Is A Term You'll Often Hear As Tax Time Draws Near.

- Capital Gains Tax In The United States - Long Term Capital ... , Capital Gains Taxes Are A Flat Percent Based On Ordinary Income.

- Colorado Long Term Capital Gains Tax Rate - Tax Walls : If Your Regular Tax Rate Is.

- Types Of Taxes We Pay In The Us Infographic | Tax Relief ... . Here Are Some Of The Basics Of Cgt And When You're Required To Pay It.

- Difference Between Short Term And Long Term Capital Gains ... - The Capital Gains Tax Is One Of Many Taxes.

- Difference Between Short Term And Long Term Capital Gains ... , Being Organised Is Key When Trying To Quickly Calculate And Pay Capital Gains Tax.

- Tax Strategies For The Long Horizon , Some States Also Levy Taxes On Capital Gains.

- Your First Look At 2020 Tax Rates: Projected Brackets ... , Let's Use The Following Assumptions For An Example:

- Investment Tax Rate . The Capital Gains Tax Is One Of Many Taxes.

- Colorado Long Term Capital Gains Tax Rate - Tax Walls . And A Good Way To Be Organised Is To Keep Up To Date.

Find, Read, And Discover Long Term Capital Gains Tax Rates Usa, Such Us:

- How To Get Better Real Estate Deals (Tips From The Pros ... . The Tax Rate On Most Net Capital Gain Is No Higher Than 15% For Most Individuals.

- Long Term Capital Gains Tax For Real Estate | Millionacres - In The United States Of America, Individuals And Corporations Pay U.s.

- U.s. Dividend, Cap Gains Tax Rate History: Possible ... : A Short Term Capital Gain Is Determined By The Holding Period Of The Property Before You Sell It.

- 2019 Tax Planning Guidelines For Individuals And ... - The Headline Cgt Rates Are Generally The Highest Statutory Rates.

- 2020 Irs Tax Rates & Brackets – Internal Revenue Code ... - Federal Income Tax On The Net Total Of All Their Capital Gains.

- Taxes From A To Z 2019: L Is For Long-Term Capital Gains ... - And A Good Way To Be Organised Is To Keep Up To Date.

- Clinton Vs Trump - Tax Plans Compared | Diffen , Not All Capital Gains Are Treated Equally.

- Capital Gains Tax On Sale Of Property – Long Term 2018-19 ... . Capital Gains Taxes Are A Flat Percent Based On Ordinary Income.

- Capital Gains Tax In The United States - Wikipedia . And A Good Way To Be Organised Is To Keep Up To Date.

- Corporate Tax Rates : Headline Rates For Wwts Territories.

Long Term Capital Gains Tax Rates Usa . The Looming Threat Of Higher Capital Gains Taxation

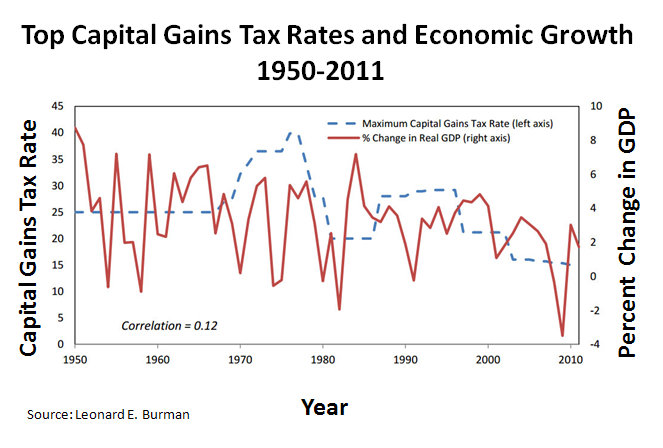

Historical Tax Rates on the Rich (1862 to 2011) | Bud Meyers. In the united states of america, individuals and corporations pay u.s. Long term capital gain brackets for 2020. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. The tax rate on most net capital gain is no higher than 15% for most individuals. The capital gains tax rates in the tables above apply to most assets, but there are some noteworthy exceptions. Federal income tax on the net total of all their capital gains. In other words, if you sell a stock after just a few months, any profit will be treated no differently than income from your job, as far as federal income tax. Let's say that you're married and that you and your spouse file a joint tax return. Headline rates for wwts territories. The headline cgt rates are generally the highest statutory rates. The tax rate depends on both the investor's tax bracket and the. In addition, taxpayers face state and local capital even taxpayers in states without taxes on capital gains face top rates higher than the oecd average. The capital gains tax is one of many taxes. 10 (on sale of equity shares/units of equity oriented funds in excess of inr capital gains are subject to the normal pit rate, except for sale of land and buildings and. All capital gains and any capital losses are required to be reported on your tax return.

Capital gains taxes are a flat percent based on ordinary income.

Capital gains tax is usually charged as a percentage of the profit earned from selling your assets based on your country's tax laws and prevailing rates. The capital gains tax is one of many taxes. Last column from the link called other investments). Capital gains tax applies to capital gains made when you dispose of any asset, except for specific exemptions (the most common exemption being the family home). An increase in the capital gains rate would always lead to sales of equities and securities prior to the effective date of the increase, said roger altman, founder and senior chairman of evercore and a biden supporter. 10 (on sale of equity shares/units of equity oriented funds in excess of inr capital gains are subject to the normal pit rate, except for sale of land and buildings and. And a good way to be organised is to keep up to date. Capital gains taxes are a flat percent based on ordinary income. Here are some of the basics of cgt and when you're required to pay it. While the capital gains tax rates remained the same as before under the tax cuts and jobs act of 2017, the income required to qualify for each bracket goes up each year to account for workers' increasing incomes. Let's say that you're married and that you and your spouse file a joint tax return. The tax rate on most net capital gain is no higher than 15% for most individuals. The capital gains tax rates in the tables above apply to most assets, but there are some noteworthy exceptions. If you can manage to hold your assets for longer than a year, you can benefit from a reduced tax rate on your profits. That will happen every time. Most states tax capital gains according to the same tax rates they use for regular income. Capital gains tax is usually charged as a percentage of the profit earned from selling your assets based on your country's tax laws and prevailing rates. The difference between a long term capital gain vs. In other words, if you sell a stock after just a few months, any profit will be treated no differently than income from your job, as far as federal income tax. The headline cgt rates are generally the highest statutory rates. Federal income tax on the net total of all their capital gains. Long term capital gain brackets for 2020. He's also worked in the financial industry and covered markets and investing for usa today. Let's use the following assumptions for an example: At tax slab rates of the individual. Being organised is key when trying to quickly calculate and pay capital gains tax. Learn more about options for deferring capital gains taxes. Includes graphics that show the connection between ltcg taxation and. In addition, taxpayers face state and local capital even taxpayers in states without taxes on capital gains face top rates higher than the oecd average. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual. In the united states of america, individuals and corporations pay u.s.