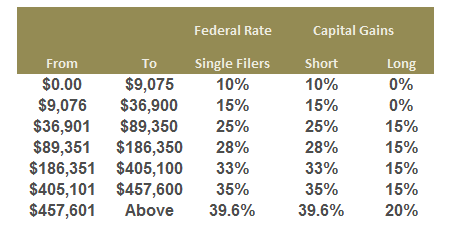

Short Term Capital Gains Tax Rate 2020 Table. Put in your income with and without the capital ga. For most people, the capital gains tax does not exceed 15%. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate. These mytax 2020 instructions are about capital gains tax events, capital gains (income) and capital losses. Long term capital gain brackets for 2020. 2020 qualified business income deduction thresholds. Here are the 2020 capital gains tax rates. Using the table below, choose the exemption or rollover code that best describes your circumstances. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income. States also have an additional tax rate between 2.90% and 13.30%. Here's a nice income tax estimator. If more than one code applies, choose the code that applies to the largest amount of. The actual rates didn't change for 2020, but the income brackets did adjust slightly. The capital gains tax rate for 2020 ranges from 0% to 28%. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation.

Short Term Capital Gains Tax Rate 2020 Table Indeed recently has been sought by consumers around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the post I will discuss about Short Term Capital Gains Tax Rate 2020 Table.

- The Tax Impact Of The Long-Term Capital Gains Bump Zone : If You Buy And Sell Investments, You Need To Know The Capital Gains Basics Or You Are At Risk Of Significant Losses Through Bad Tax Planning, An Irs.

- T05-0160 - Reduction In Rates For Long-Term Capital Gains ... - What Capital Gains Tax (Cgt) Is, How To Work It Out, Current Cgt Rates And How To Pay.

- Your First Look At 2020 Tax Rates: Projected Brackets ... . Most States Tax Capital Gains According To The Same Tax Rates They Use For Regular Income.

- Taxes From A To Z 2019: L Is For Long-Term Capital Gains ... : Short Term Capital Gains Are Taxed At Your Ordinary Income Tax Rate, Which Varies With Your Total Income.

- 9 Ways To Reduce Or Avoid Capital Gains Tax When You Sell ... - Updated For Tax Year 2020.

- Mutual Fund Taxation Fy 2017-18 And Capital Gain Tax Rates ... : Taxed At Ordinary Income Tax Rate.

- 9 Ways To Reduce Or Avoid Capital Gains Tax When You Sell ... : Calculate The Capital Gains Tax On A Sale Of Real Estate Property, Equipment, Stock, Mutual.

- What You Need To Know About Crypto Taxes . This Table Provides An Overview Only.

- Fed Tax Table 2019 | Www.microfinanceindia.org . So, If You're Lucky Enough To Live Somewhere With No State Income Tax.

- Insight To Irs Rates For 2020 - Alliance Law Firm ... : Long Term Capital Gain Brackets For 2020.

Find, Read, And Discover Short Term Capital Gains Tax Rate 2020 Table, Such Us:

- Bitcoin 10.000$!!!! What's Next? . Covering Easy To Understand Definition, Short Term, Long Term, Its Classification Along With Stcg, Ltcg Tax Rates, Cost Of Inflation Index Income From Capital Gains Is Classified As Short Term Capital Gains And Long Term Capital Gains.

- What You Need To Know About Crypto Taxes . 7 2020 Tax Planning Tables.

- All You Wanted To Know About Mutual Fund Taxation : 2020 Capital Gains Tax (Everything You Need To Know!) Oncashflow.

- How Roth Ira Conversions Can Escalate Capital Gains Taxes ... . See Our Distributions Page For A Complete List Of Each Fund's Distribution Frequency.

- Tax Implications Of Selling Commercial Real Estate [2020 ... . This Table Provides An Overview Only.

- 2018 Cryptocurrency Tax Rules - The Cryptocurrency Forums : Again, If You Make A Profit On The.

- T17-0041 - Average Effective Federal Tax Rates - All Tax ... , The Headline Cgt Rates Are Generally The Highest Statutory Rates.

- How Much Is Capital Gains Tax? It Depends On Holding ... , See The Territory Summaries For More Detailed Information.

- Is A Long-Term Capital Gains Tax On Equity A Bad Idea ... , If You Buy And Sell Investments, You Need To Know The Capital Gains Basics Or You Are At Risk Of Significant Losses Through Bad Tax Planning, An Irs.

- Michigan Family Law Support - January 2019 : 2019 Federal ... : The Actual Rates Didn't Change For 2020, But The Income Brackets Did Adjust Slightly.

Short Term Capital Gains Tax Rate 2020 Table . Income Tax And Capital Gains Rates 2017 - Skloff Financial ...

Could Capital Gains Tax Erode your Texas Home Equity .... You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation. 2020 qualified business income deduction thresholds. Long term capital gain brackets for 2020. Here are the 2020 capital gains tax rates. States also have an additional tax rate between 2.90% and 13.30%. Here's a nice income tax estimator. Using the table below, choose the exemption or rollover code that best describes your circumstances. Put in your income with and without the capital ga. These mytax 2020 instructions are about capital gains tax events, capital gains (income) and capital losses. If more than one code applies, choose the code that applies to the largest amount of. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income. For most people, the capital gains tax does not exceed 15%. The actual rates didn't change for 2020, but the income brackets did adjust slightly. The capital gains tax rate for 2020 ranges from 0% to 28%.

For most people, the capital gains tax does not exceed 15%.

Here's a nice income tax estimator. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate. Capital gains are taxed depending on what kind of capital asset you've invested in and how long you held that asset. Long term capital gain brackets for 2020. 7 2020 tax planning tables. They're taxed like regular income. Rate is 5% for basic investment funds and 0% for some types of pension funds. What is the capital gains tax on property sales? The headline cgt rates are generally the highest statutory rates. Access the 2020 tax distributions for blackrock funds. 2020 capital gains tax (everything you need to know!) oncashflow. Put in your income with and without the capital ga. What capital gains tax (cgt) is, how to work it out, current cgt rates and how to pay. For the 2020 to 2021 tax year the allowance is £12,300, which leaves £300 to pay tax on. The actual rates didn't change for 2020, but the income brackets did adjust slightly. Capital gains tax long term vs short term. Updated for tax year 2020. So, if you're lucky enough to live somewhere with no state income tax. These mytax 2020 instructions are about capital gains tax events, capital gains (income) and capital losses. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate. Know about long term & short term capital assets, calculation, exemption & how to save tax on agricultural land. 20% rate applies to certain capital gains. If more than one code applies, choose the code that applies to the largest amount of. Most states tax capital gains according to the same tax rates they use for regular income. 2020 qualified business income deduction thresholds. The 2020 tax brackets are 10 percent, 12 percent, 22 percent, 24 these gains specify different and sometimes higher tax rates. This table provides an overview only. Your gains are not from residential property. Not all capital gains are treated equally. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains. Using the table below, choose the exemption or rollover code that best describes your circumstances.