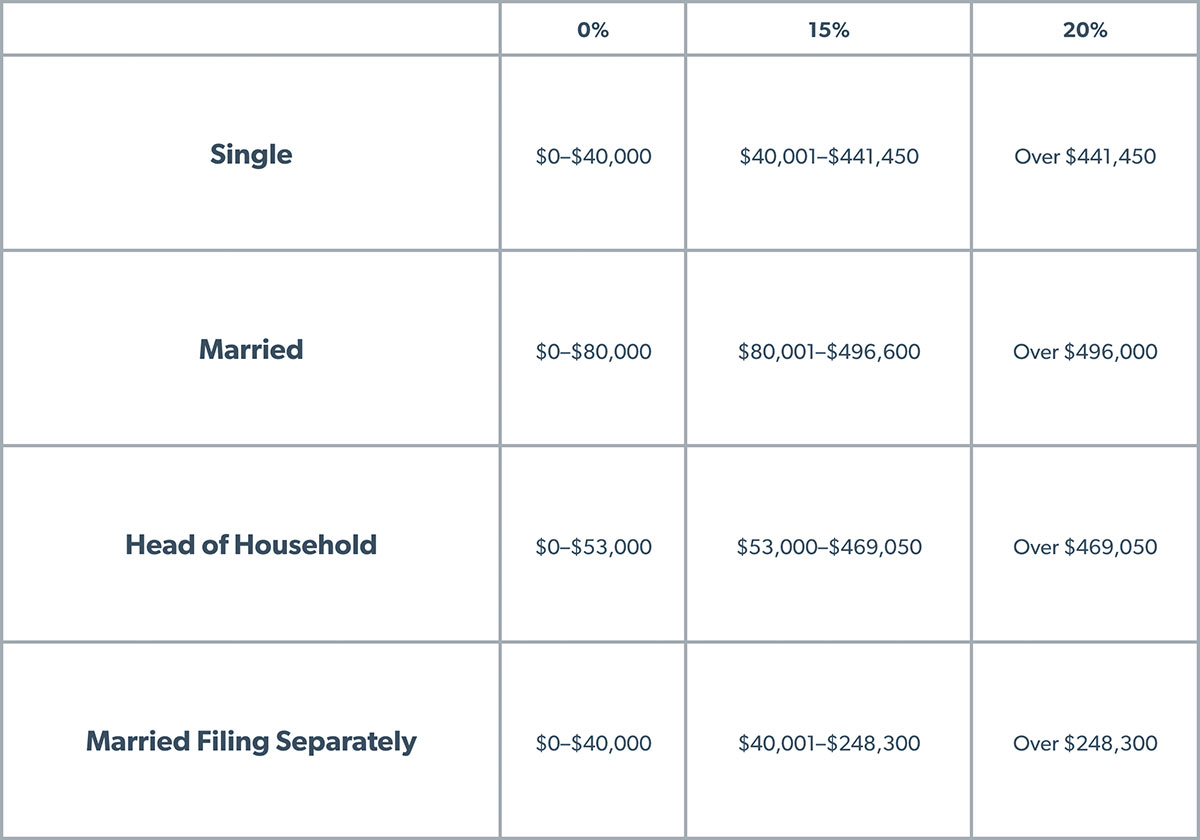

Short Term Capital Gains Tax Rate 2020 Usa. Here are the 2020 capital gains tax rates. Federal income tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the. Put in your income with and without the capital ga. How much these gains are taxed depends a lot on how long you held the asset before selling. Here's a nice income tax estimator. In the united states of america, individuals and corporations pay u.s. The 2020 tax brackets are 10 percent, 12 percent, 22 percent, 24 these gains specify different and sometimes higher tax rates. In 2020 the capital gains tax rates are either 0%, 15% or 20% for. As the tables below for the 2019 and 2020 tax years show, your overall taxable income determines which of these rates will get charged on your capital gains. Long term capital gain brackets for 2020. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation. What is the capital gains tax on property sales? Again, if you make a profit on the.

Short Term Capital Gains Tax Rate 2020 Usa Indeed lately has been hunted by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this article I will talk about about Short Term Capital Gains Tax Rate 2020 Usa.

- Capital Gains Calculator For 2019 & 2020 | Capital Gain ... - In 2020 The Capital Gains Tax Rates Are Either 0%, 15% Or 20% For.

- How Tax Efficient Are Your Investments? – The Anatomy Of ... : 2020 Capital Gains Tax Rates And Rules.

- Pay Short-Term Capital Gains Tax On Idrs At Slab Rates - Updated For Tax Year 2020.

- Capital Gain Income Tax | Short Term Capital Gain Tax ... , States Also Have An Additional Tax Rate Between 2.90% And 13.30%.

- Long Term/Short Term Capital Gain Tax On Shares ... : Long Term Capital Gain Brackets For 2020.

- How To Work Smarter, Not Harder: Your 3 Income Types ... . The Tax Rate Depends On Both The Investor's Tax Bracket And The.

- Capital Gains Calculator For 2019 & 2020 | Capital Gain ... : Not All Capital Gains Are Treated Equally.

- 2019 Tax Planning Guidelines For Individuals And ... , What Is The Capital Gains Tax On Property Sales?

- Capital Gains Tax – The Long And Short Of It – Mymoneysage ... - State Individual Income Tax Rates And Brackets For 2020.

- 2019-2020 Long-Term Capital Gains Tax Rates | Capital ... : If You Sell An Asset You Have Held.

Find, Read, And Discover Short Term Capital Gains Tax Rate 2020 Usa, Such Us:

- 2019 - 2020 Capital Gains Tax Rates - Go Curry Cracker! . State Individual Income Tax Rates And Brackets For 2020.

- Clinton's Cap Gains Tax Proposal Vs Status Quo - Straight ... : This Guide Explains Capital Gains Tax For Individuals Who Have Sold Their Main Residence, For Individuals With Complex Capital Gains Tax Obligations A Company, Trust Or Superannuation Fund May Be Required To Complete And Lodge A Capital Gains Tax (Cgt) Schedule 2020 (Nat 3423) (Cgt Schedule) As.

- Capital Gains Rates Before And After The New Tax Law - Mueller . Most States Tax Capital Gains According To The Same Tax Rates They Use For Regular Income.

- Types Of Taxes We Pay In The Us Infographic | Tax Relief ... . Not All Capital Gains Are Treated Equally.

- Long-Term Capital Gains Tax , See Our Distributions Page For A Complete List Of Each Fund's Distribution Frequency.

- Obamacare’s Tax On Home Sales Is Nothing New | Tax Foundation , Capital Gains Taxes Are The Taxes You Pay On Profits From Most Investments, Including Stocks, Bonds, Or Mutual Funds.

- What You Need To Know About Crypto Taxes . In 2020 The Capital Gains Tax Rates Are Either 0%, 15% Or 20% For.

- Income Tax And Capital Gains Rates 2020 - Skloff Financial ... . Most States Tax Capital Gains According To The Same Tax Rates They Use For Regular Income.

- Long Term & Short Term Capital Gains Tax Rate For 2013 ... - Albania (Last Reviewed 22 June 2020).

- How To Use Mf, Stock Losses To Reduce Your Tax Burden (Tax ... - Tax Treatment Of Other Investments.

Short Term Capital Gains Tax Rate 2020 Usa , Finance | Achieving Your Goals

Ordinary Income vs Capital Gains: Explanation, Examples .... Federal income tax on the net total of all their capital gains. Long term capital gain brackets for 2020. Put in your income with and without the capital ga. How much these gains are taxed depends a lot on how long you held the asset before selling. Again, if you make a profit on the. What is the capital gains tax on property sales? In 2020 the capital gains tax rates are either 0%, 15% or 20% for. As the tables below for the 2019 and 2020 tax years show, your overall taxable income determines which of these rates will get charged on your capital gains. Here are the 2020 capital gains tax rates. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation. In the united states of america, individuals and corporations pay u.s. The 2020 tax brackets are 10 percent, 12 percent, 22 percent, 24 these gains specify different and sometimes higher tax rates. The tax rate depends on both the investor's tax bracket and the. Here's a nice income tax estimator. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income.

Federal income tax on the net total of all their capital gains.

Ishares edge msci multifactor usa index fund. This guide explains capital gains tax for individuals who have sold their main residence, for individuals with complex capital gains tax obligations a company, trust or superannuation fund may be required to complete and lodge a capital gains tax (cgt) schedule 2020 (nat 3423) (cgt schedule) as. If you buy and sell investments, you need to know the capital gains basics or you are at risk of significant losses through bad tax planning, an irs. States also have an additional tax rate between 2.90% and 13.30%. Access the 2020 tax distributions for blackrock funds. Quick and easy guide on capital gains. 2020 capital gains tax (everything you need to know!) Federal income tax on the net total of all their capital gains. Data as of march 2020. Individual capital gains tax rate (%). Here are the capital gains tax rates for 2020 and beyond. 2020 capital gains tax rates and rules. Long term capital gain brackets for 2020. Assets that attract short term capital gains tax a capital gains tax is not levied on an inherited property since it is just a transfer of ownership and not an actual sale. Put in your income with and without the capital ga. How much these gains are taxed depends a lot on how long you held the asset before selling. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Albania (last reviewed 22 june 2020). The ots report says most gains are concentrated among relatively few taxpayers. Short term capital gains are taxed at your ordinary income tax rate, which varies with your total income. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. State individual income tax rates and brackets for 2020. You will be taxed at your ordinary income tax. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation. Some or all net capital gain may be taxed at 0% if your taxable. Here's a nice income tax estimator. Covering easy to understand definition, short term, long term, its classification along with stcg, ltcg tax rates, cost of inflation index income from capital gains is classified as short term capital gains and long term capital gains. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual fund, or. What is the capital gains tax on property sales? In the united states of america, individuals and corporations pay u.s. In 2020 the capital gains tax rates are either 0%, 15% or 20% for.